(-issuer) may instruct the depositary to perform actions in relation to a certain number of securities in the securities account. The peculiarity of the order is the lack of instructions regarding the individual characteristics of certificates and basic securities (category, series, number).

Open storage method: essence, place in classification

The main object of activity of the depository- securities issued by Russian companies (residents of the country). The depositary may service securities whose issuers are non-residents in a situation where this fact does not contradict the requirements of a number of regulations and legislative norms. The task of the depository is to ensure storage and accounting of the following assets:

Having an undocumented form;

- documentary type, characterized by mandatory storage in special institutions;

- documentary type without special requirements for centralized storage;

- emission and non-emission type;

- registered bearer type.

The main methods of accounting for assets stored in a depository include:

1. Open method implies that the depository takes into account only the total number of assets of the issuer. Individual characteristics such as rank, series or number are not indicated. There is also no provision for indicating individual characteristics of certificates. Another special feature of the open method is that the depositary can give instructions only in relation to the total number of assets in the depositary’s account. Individual characteristics are not taken into account.

2. Closed method- a special option for storing securities, which involves not only recording the number of assets, but also indicating their personal (individual) characteristics. A closed method is an opportunity for a depositor to transmit instructions in relation to specific securities stored and accounted for in a securities account, as well as having a number of individual characteristics. Work is carried out only with documentary-type securities. Accounting for assets is carried out by registering a counter of numbers containing data identifying the owner, as well as the storage location.

3. Marked option- storage of assets on the personal account of the client (issuer). With such storage, all instruments are divided into groups, each of which includes securities with their own terms of issue. The client (depositor) has the right to instruct to perform actions in relation to securities with a precise indication of the characteristics or group in which it is stored. The marked storage option implies that the depository maintains a directory with a group of characteristics that allow identifying features and groups.

In addition to those described above, there are two more storage options: :

- safe. In this case, the depositor and the depository do not maintain constant communication. The depository performs only the functions of a repository (safe) for the issuer’s values;

- connected. With this type of storage, the depository performs a number of functions in relation to clients and its assets - accounting, storage, as well as information services. Thus, the depositary can notify about the time of shareholders’ meetings and the payment of profits on assets. In addition, the depository has the right to combine the functions of a transfer agent or paying agent.

Securities held in depository accounts are counted in pieces. Securities, the terms of issue of which imply the issue of assets of different denominations, are considered taking into account the par value. The depositary may personally determine the storage schemes it uses if a specific storage method is not specified in the conditions for issuing the asset.

Open storage method: nuances of reception and accounting

An important point in the work of the depository is the organization of registration and storage of securities. The basis for conducting a transaction is an order from the client (initiator) to complete the transaction, as well as a notification to the registrar regarding the transaction for crediting securities to the “custodian” account. If it is not possible to compare the order and notification, the depositary may require confirmation of this correspondence.

When conducting a transaction in another depository, where the client’s securities are taken into account under the terms of another depository, the custodian may require the company to present an additional package of securities in relation to the requirements of the other depositary party.

When conducting a transaction in another depository, where the client’s securities are taken into account under the terms of another depository, the custodian may require the company to present an additional package of securities in relation to the requirements of the other depositary party.

Acceptance of documentary-type securities for open storage (accounting) has the following aspects :

The depository company can store documentary-type securities taking into account the requirements and norms of the Russian Federation;

The depository may transfer documentary-type securities for accounting and storage to another depository with which an interdepository agreement has been signed. In this case, accounting or storage of order or bearer assets is carried out by transferring assets to a special securities account of the depository with which the deposit agreement has been concluded. In this case, the assets are stored with another depository, taking into account the conditions of its storage;

The documents used when completing a transaction are a memorial order, which implies an accounting of valuables, as well as an act of acceptance and transfer of assets.

Accepting for open storage of assets intended for qualified market participants, the depository credits these assets to the holder's depository account if the latter is qualified. Acceptance is also carried out in a situation where the client is not a qualified investor, but purchased securities taking into account the current legislation.

The depository may credit securities limited in circulation to the depositary account of nominee owners in the event that the accounts are opened by another depositary party. In addition, the deposit may be made to the depository of the pledge holder or trustee.

Stay up to date with all the important events of United Traders - subscribe to our

When you buy stocks or bonds on the stock market, you don't physically see them. Most securities are in book-entry (electronic) form. And your right to this or that paper is recorded with a digital code in special storage facilities - depositories.

What is a depository in simple words

When concluding an agreement with a broker, two accounts are opened for you: brokerage and depository.

Money is stored in a brokerage account. On the depository - purchased securities. Or rather, records about the name and number of securities in your portfolio.

A depository is an electronic storage of data confirming the rights of owners to securities.

In simple words, a depository is a regular server where transactions involving a change of owners as a result of transactions on the stock market are recorded.

The depository's operating system resembles a non-cash bank account. You perform operations: deposits and withdrawals, purchases and transfers. In reality, no one keeps your money separately. Does not report when replenishment or receipt of salary. Does not count from the accumulated amount for purchases and does not transfer money to the seller. Only the numbers that reflect the current balance change on the account.

In the Russian stock market, the central depository is NSD - the national settlement depository. Owned by the Moscow Exchange (99.997% shares).

Some statistics on NSD’s work:

- The volume of securities in storage is more than 40 trillion rubles.

- An average of 2-3 million transactions are recorded quarterly.

- The trading volume in monetary terms exceeds 100 trillion rubles (per quarter).

There is also NCC - a national clearing center. Inspects transactions between market participants. And acts as an intermediary between buyers and sellers.

Large brokers have their own private depositories to record clients' securities. Smaller companies usually have rented ones.

Why are several depositories needed?

NSD keeps records of securities only at the level of accredited market participants. In our case, brokers. He does not share how many shares belong to Petrov, Ivanov or Sidorov. And it takes into account only the total number of securities purchased through a broker.

You bought 100 shares of Gazprom, Ivanov - 200 and Petrov - 1,000. The register of the national depository will indicate: 1,300 shares are assigned to the broker.

And already at the broker level, in his own depository, a breakdown into clients occurs.

How it works

When purchasing securities, a change of owners occurs.

You submit an order to the broker to buy 10,000 shares of Sberbank. The broker checks whether you have the required amount of money in your account for the purchase. If yes, then he submits the application on his behalf to the exchange. A deal is being made.

NCC verifies the correctness of the transaction. At the end of the trading session, it transfers information about the new owner to the central depository (NSD). There the right to the purchased securities is assigned to the new owner. And only then the information goes to the private depository. And only at this level does the separation of securities owners occur.

What is it for

Other functions of the depository are the transfer of dividends on shares, coupon income on bonds, participation in meetings and voting of shareholders, and repurchase of shares.

For private investors, the first two functions will be of interest - dividends and coupons.

Owners of bonds and dividend stocks receive payments into a brokerage or bank account. And almost no one thinks about how this happens. The money arrives in the account and is good.

Each company traded on the stock market has tens or hundreds of millions of shares issued. The number of paper holders can be in the tens or hundreds of thousands. And everyone needs to pay the required dividend income. How to find out to whom, how much and where to transfer the monetary reward?

This is where the depository comes to the rescue.

The company transfers money (dividends, coupons) to the national settlement depository. NSD verifies the eligibility of each private depository to receive payment. And transfers funds in proportion to the ownership share. The money is then distributed to clients. Less withholding taxes on income (if taxable).

What is the price?

And even if the broker’s tariffs do not include such a column as “depository fee”, this does not mean that you do not pay for it.

Perhaps the cost of service is simply a "protection" in trading commissions. Or it is included in the minimum monthly fee that the investor or trader must pay to the broker.

The depository fee, indicated in the tariffs as a separate line, is charged according to the following criteria:

- Fixed - 100-300 rubles per month (if any transaction was made during the reporting period). There were no transactions - no fees were charged.

- Minimum - regardless of the availability of transactions, a certain amount is taken every month. In annual equivalent it is approximately 0.005 - 0.01% of the portfolio value. But not less than 100-300 rubles per year. Some brokers take 100-200 rubles monthly.

- If the brokerage account exceeds the amount of 50-100 thousand, the fee may not be charged.

Securities are popular with many bank clients. Based on this, banking organizations began to offer their services for storing, recording, transferring and withdrawing these documents from accounts. Each security - stock, bond, bill, etc. - has a certain amount of money behind it that needs to be saved so that it does not fall into the wrong hands. You can, of course, use a home safe, but the risk is too great. You can also take it to a specialized company that deals with such matters, but who can guarantee that the company will not “run away” with all the valuables accepted for storage. Therefore, the most optimal and reliable option for storing securities remains a bank. It has several degrees of protection, and all conditions and actions between the client and the bank are drawn up in writing. This guarantees increased security for storing securities.

Why does a bank hold securities?

The activity of storing securities is called depository. To engage in it, you need to obtain the appropriate permission and license. Most banks are authorized to engage in this type of business.

The question arises: why does a bank need to store securities? It's all about profit. For its depository services, the bank charges a good commission, which increases its income in the aggregate.

Banks can store securities (c/w):

- In cash, as a value.

- In non-cash form, if the paper does not have a physical form, but exists non-cash.

Storage of securities in physical form is carried out by placing them in safe deposit boxes or a special bank vault, which comply with standard storage requirements and the procedure for organizing work with them. The client can determine the storage periods independently.

Securities are accepted for storage upon the conclusion of a special agreement, which specifies all the conditions for the provision of such a service, and an act of acceptance of the transfer, which specifies the data of the values being given away and which serves as a personal safe-keeping document. Usually, one type of securities is accepted under one agreement: shares, bills, bonds, certificates, etc. The number of accounts for storing securities is not limited. During the admission process, documents are checked for authenticity.

For such a service the client pays a commission. Its size may vary depending on the bank, terms of the agreement, and individual agreements. The size of the commission can be fixed or depend on the denomination of the stored certificates.

It is worth noting that storing and servicing securities in cash implies higher costs than storing them in non-cash form in accounts, so non-cash turnover is several times higher than turnover in physical form.

Storing securities in accounts.

Securities stored by the bank in non-cash form are reflected in special accounts called “depo”. Managing securities on this account is no different from managing funds on current accounts. Some banks provide clients with a remote service system with a fairly convenient interface so that they can conduct transactions with their securities.

One securities account records securities of the same issue and identical depository operations.

The coding of the custody account is determined by the bank independently.

An example of securities account coding.

The account structure consists of 15 characters, grouped into sections: AABBBBBBBBBVGGYYY, where

AA – type of securities account. Its possible values:

40 – owner’s account.

50 – broker account.

90 – transit account, etc.

BBBBBBB – bank client code.

B – control digit.

YYYYY is the serial number of an account of this type for a specific client.

Let's look at the structure of the Sberbank securities account.

It adopted a 12-digit encoding: 0002 AAAAAAA 01, where

002 — custody account,

ААААА - investor section and agreement code:

100000 - main section,

210000 - section of out-of-circulation securities,

220000 - c/w at auction,

280000 - c/w out of circulation, etc.

01 - stock code, i.e. whose shares are held in the account

How to transfer or withdraw securities from an account?

The transfer of certificates may be associated with the payment of a monetary transaction or for independent reasons. To transfer securities between accounts, you need to fill out an order for the transfer of securities. It indicates the type of securities, quantity, recipient details and other mandatory data. The order is filled out at the branch or via online banking. The bank, having received such an order, debits the securities from the account of their owner and credits them using the specified details. This operation is similar to a money transfer.

If a client transfers securities stored in cash at a bank, then in this case only the owner changes, and the certificates themselves remain in the storage facility.

To withdraw securities from the account, the client must draw up a withdrawal order. The certificate of delivery and acceptance of securities from the account serves as evidence of the issuance of securities to the client. The report on the execution of the client's order to withdraw securities from the securities account is an extract. The withdrawn non-cash securities are transferred to the client's account in another depository. It is not possible to receive non-cash securities in cash.

In other words, the depository maintains accounts that record the securities transferred to it by clients for safekeeping, and also directly stores the certificates of these securities. Maintaining accounts gives the depositary the opportunity to record (certify) ownership of securities and take into account those property rights that are secured by them. Accounts intended for recording securities are called "custody accounts", and the client is called depositor.

When collecting a register for one of the deposited issues of securities (if the issuer needs it), the depositary, being a nominal holder, will inform the registrar of the names of the true owners. However, in many cases, issuers choose not to collect a complete register, but rather perform their duties with the help of a depositary. For example, when paying dividends, the issuer transfers to the depository an amount of money corresponding to the number of securities held in the depositary's account. The depository, in turn, transfers dividends to its clients in accordance with the number of securities of this issue held in their custody accounts. This gives rise to another function of the depository. He is an intermediary between the issuer and the investor.

That. the depositary can provide its depositors with custodial services, which facilitate the implementation by owners of property rights secured by securities, for example, participation in the management of a joint-stock company, receipt of income from securities, verification of the authenticity of securities certificates, execution of securities certificates and their transfer to third parties, etc.

In order for the depository to fully perform its intermediary functions, its position must be “legalized.” As a rule, for this purpose the depositary becomes nominal holder or by concluding an agreement with the issuer, head depository for this issue of securities.

The depositary may be only legal entity. Activities of the depository can be combined with other types of professional activities on the securities market, except for register maintenance activities holders of securities. Most often, depository activities are combined with activities to identify mutual obligations under transactions (settlement and clearing activities).

Depository activities are subject to licensing. A license to carry out depository activities is issued for a period of up to three years. The main requirements for obtaining a license are financial security and professional suitability.

An agreement on a “depo” account is concluded between the depositor and the depository, which regulates their relations in the process of depository activities. Such an agreement is called a depository agreement. The depositary bears civil liability for the safety of the securities certificates deposited with it.

Depositories service securities issued in both cash and non-cash form.

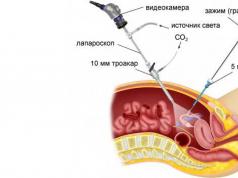

The depository can store securities in two ways: in open (collective) and closed (separate) forms.

Storage in open (collective) form means that the depository in relation to these securities not only performs the functions of storage and maintenance, but also manages them, i.e. takes part in shareholder meetings and has the right to vote. This type of storage is similar to a trust. In this case, the nominee holder of the securities is called a voting nominee.

Securities, the certificates of which are deposited with the depository under open storage conditions, represent the shared ownership of all clients of the depository who deposited securities of the same issue with it. The ownership of securities by specific clients is not identified by numbers or series.

Open storage securities certificates are stored by the depository jointly by issue without being sorted by clients, and can also be transferred for storage to secondary depositories on open storage terms.

Securities issued by global certificates may only be held in open custody.

Storage in closed (separate) form means that the depository is engaged only in the storage and servicing of these securities. Securities are managed by their owner. The depositary acts as a nominee holder without voting rights.

Certificates of such securities are kept separately from securities of other clients and securities owned by the depository itself. These certificates must be provided to the client upon his first request. The depositary cannot delegate the storage of such securities, pledge them, transfer them as a loan, or carry out other transactions with them other than those expressly agreed upon in the storage agreement with the client.

Depositories are currently divided into settlement and custodial.

Settlement depositories serve participants in organized markets. They are called settlement because, in addition to depository activities, they conduct settlements on transactions or interact with clearing and trading systems to ensure settlements on transactions with securities of their depositors.

Custodial depositories provide services to the direct owners of securities, which is why they are often called client services. In Russia they are divided into:

1) specialized - serve mutual investment funds or a specific issuer, which, when issuing its certified registered securities, decided on their mandatory centralized storage;

2) non-specialized - combine depository activities with intermediary activities (brokerage, dealer, securities management activities).

The depositary, based on the order of the client-seller, makes a preliminary write-off of securities from his “depo” account and credits them to the buffer (intermediate) “depo” account. In order to reflect all the details of the state of securities, the concept of a personal securities account is introduced. Personal depository account– the minimum unit of depository accounting. It takes into account securities of the same issue that are in the same condition. Personal accounts are opened as needed when performing certain depository operations. The totality of the owner’s personal accounts forms his securities account.

Some personal accounts may be united by a common feature. For example, securities of several issues pledged under one agreement, or all securities offered for trading within one trading system, etc. Therefore, to more accurately reflect in depository accounting the relations that arise in the stock market during the circulation of a security, the concept appears "depo account section", which consists of one or more personal accounts united by a common characteristic. The securities account section corresponds to a certain document that describes the basic rules for working with personal accounts included in this section.

By analogy with cash accounts, securities accounts are passive and active. On passive accounts securities are accounted for by owners, and on active accounts - by storage location. The design of an active securities account completely repeats the design of a passive securities account. The active depository account is also divided into personal accounts, which can be combined into sections. Each security held in the depositary is counted twice: as an asset and as a liability. This gives rise to the concept "depot balance": the depositary's obligations to clients must be secured by the assets available for storage separately for each issue of securities. This is the basic requirement of depository accounting, which allows it to be as close as possible to the standard rules of monetary balance sheet accounting.

The work of the depository is expressed in the depository operations it carries out. Depository operation– a set of actions of the depository with accounting registers, stored securities certificates and other depository accounting materials. The following classes of depository operations can be distinguished: administrative, inventory, information, complex and global.

Administrative Operations related to the opening and closing of securities accounts. They can be of two types: a depository account of the depositor and a securities account at the place where the securities are stored.

Inventory operations change the balance of securities in a securities account, therefore they are associated with the acceptance of securities, their transfer or movement, as well as with the removal of securities from storage or accounting.

Information Operations are associated with the preparation of reports and certificates on the status of the securities account on behalf of depositors.

Complex Operations– these are operations that include elements of different classes of operations. For example, the depository may block the depositor's securities, i.e. it temporarily stops the movement of securities across accounts. Such an operation has features of both administrative and inventory operations.

Global Operations of the depositary affect all securities of a particular issue or a significant part of them. Such transactions are carried out at the initiative of the issuer and are associated with the payment of income on securities, redemption of debt securities, conversion of bonds or shares.

A SETTLEMENT AND CLEARING ORGANIZATION is a professional participant in the securities market, a specialized organization that provides settlement services to participants in the organized securities market and identifies their positions based on the results of concluded transactions.

The main goals of such an organization:

1) identifying the positions of transaction participants and their settlement;

2) reducing costs for settlement services for market participants;

3) reduction of calculation time;

4) reduction to a minimum level of all types of risks that occur during calculations.

A settlement and clearing organization may exist in the form closed joint stock company or non-profit partnership and must have a license from the Federal Securities Market Commission, which is issued for a period of up to three years. She can serve any one stock exchange or several stock exchanges or securities markets at once.

The activities of settlement and clearing organizations include:

1) conducting settlement transactions between members of the settlement and clearing organization (and in some cases, other participants in the stock market);

2) offsetting mutual claims between settlement participants, or clearing;

3) collection, reconciliation and adjustment of information on transactions made in the markets served by this organization;

4) development of a settlement schedule, i.e. establishing strict deadlines within which funds and related information and documentation must arrive at the settlement and clearing organization;

5) control over the movement of securities (or other assets underlying exchange transactions) as a result of the execution of contracts;

6) guaranteeing the execution of contracts (transactions) concluded on the exchange;

7) accounting and documentary registration of the calculations made.

As a rule, a settlement and clearing organization is a commercial organization that must operate at a profit. Its authorized capital is formed from contributions from its members. Main sources of income:

1) fee for registering transactions;

2) proceeds from the sale of information;

3) profit from the circulation of funds at the disposal of the organization;

4) proceeds from the sale of its calculation technologies, software, etc.;

5) other income.

Without settlement and clearing organizations, trading in derivative securities – futures contracts and exchange-traded options – is impossible.

The relationship between the settlement and clearing organization and its members, exchanges and other organizations is built on the basis of relevant agreements.

Members of such an organization usually include large banks and large financial companies, as well as stock and futures exchanges.

Settlement and clearing organizations do not have the right to conduct credit and most other active operations (invest money in securities, etc.), unlike commercial banks.

ORGANIZERS OF TRADING ON THE RTS (exchange) provide services that facilitate the conclusion of transactions with securities. They can combine this activity with depository and clearing. They are required to disclose the following information to any interested party: rules for admission to trading of securities market participants and the securities themselves, conclusion and reconciliation of transactions, registration and execution of transactions, schedule of services provided, etc. For each transaction concluded in accordance with the established rules, any person is provided with information about the date and time of the transaction, the price of one security, the number of securities, etc. They should contribute to the openness of the RCB.

The main task of the exchange is to establish the market price for one or another type of securities and ensure the completion of transactions at this or a similar price concluded on the exchange. Several mechanisms are used to set the market price:

1) auctions;

2) a system with quotes and market makers;

3) application-based system;

4) a system with specialists.

Auction the system is best known and most often used for initial placement or sale of not very liquid securities. It involves collecting applications, then comparing them and selecting the most attractive ones for the counterparty. There are several options, differing in the conditions for submitting applications and concluding transactions.

1) the Dutch auction assumes that the seller, having set a deliberately inflated starting price, begins to reduce it until a buyer is found;

2) an English auction involves direct competition between buyers who consistently raise the price of the offered lot. The buyer is the one whose offer remains the last;

3) a closed auction involves the preliminary collection of applications and the subsequent selection of the most attractive one.

System with market makers(quote-driven system) is usually used for securities with limited liquidity. All trading participants are divided into two groups – market makers and market takers. Market makers undertake obligations to maintain quotes, i.e. public obligations to buy and sell these securities at prices announced by them. In exchange for such a commitment, other trading participants (market takers) have the right to enter into transactions only with market makers. Very roughly, we can compare market makers with sellers who are constantly standing on the market, and market takers with buyers who come there and, after comparing the offers of sellers, choose the most profitable one, but buy only from sellers.

Application based system(order-driven system), involves submitting bids for purchase and sale at the same time. If the prices of two orders match, the transaction is executed. This system is used for the most liquid securities, when there is no shortage of applications.

Finally, system with specialists involves dedicated participants - specialists who serve as intermediaries between brokers submitting their applications to them. Specialists enter into transactions on their own behalf with all trading participants. Their profit arises as a result of playing on small fluctuations in the exchange rate, which they are obliged to smooth out in exchange.

Technologically, any of the systems can be implemented both “on the floor” and through electronic communication networks.

Control questions

1. What are the functions of the securities market?

2. Give a general assessment of the role of the securities market for a market economy.

3. What is the procedure for issuing securities?

4. What is the procedure for registering the issue of securities?

5. What is a “prospectus”?

6. What information about securities and financial and economic activities must be disclosed by the issuer of publicly offered securities?

7. What are the features of placing securities in open (public) and closed (private) forms?

8. What types of professional activities in the securities market are allowed to be combined in Russia?

9. What is “nominal holding”?

10. What are the similarities and differences between the functions of depositories and registrars?

11. Which model (banking, non-banking, mixed) can the Russian securities market be classified as? Why?

12. What types of activities recognized as professional in the Law of the Russian Federation “On the Securities Market” relate to activities for the redistribution of monetary resources and financial intermediation and activities for organizational, technical and information services for the issue and circulation of securities?

13. What are the conditions for obtaining a license to carry out various types of professional activities in the securities market?

In the classical sense of the word, a depository is a structure that provides storage services for various types of valuables. With the development of the stock market, the main area of depository services has become the storage of securities. The activities of depositories are regulated by the Federal Law “On the Securities Market” dated April 22, 1996, “On the Central Depository” dated December 7, 2011, and the Law of the Russian Federation “On the Organization of Insurance Business in the Russian Federation” dated November 27, 1992 (as amended on July 3, 2016).

Advantages of storing securities in a depository

The turnover of securities has recently reached large proportions; they themselves have gradually become a very liquid instrument. The securities depository has significantly expanded its functionality: in addition to ensuring the safety of securities, it provides services for recording their owners and organizing the transfer of ownership rights. While in the depository's vault, a security can change its owner more than once. To do this, it is enough to make a new entry in the “deposit account” electronically. Storing securities in depository accounts increases the speed of working with them and profitability.

Firms providing brokerage services often obtain licenses for depository operations and carry them out. This is very convenient for the owner of securities: an open securities account with a company that provides services for the purchase and sale of securities allows you to carry out all operations in one place.

This principle is usually used by commercial banks and investment companies. These two areas of business should be separated according to information and territorial principles in order to prevent conflicts of interest. For example, to exclude the possibility of brokers making transactions in their own interests, using confidential data on the status of the accounts of security holders. Storing securities in a depository will help eliminate risks and preserve them even in the event of bankruptcy of the broker.

Accounting and storage of securities in the depository

The depository accounts for securities in different ways: open, closed and mixed. In an open manner, securities are stored in one personal securities account. In this case, only the total number of securities without individual characteristics (category, series, number) is subject to accounting.

In addition to storing and accounting for securities, the depositary provides its depositors with related services such as transferring dividends, participating in shareholders’ meetings, and consulting on levying taxes on income from securities. Depository services are paid by the depositor in cash. Some depositories charge fees as a percentage of the volume of securities held. Others set a fixed fee for maintaining an account.

The degree of reliability of a particular depository is determined by the rating, which includes the financial indicators of this organization, the perfection of internal procedures, the level of technological equipment, and the availability of insurance to cover various risks.

The procedure for the depository to carry out operations on securities accounts

The depository carries out all operations on securities accounts only on the basis of received instructions from account holders or their authorized representatives. The order is submitted by the client personally or using special software in electronic form, if the organization supports this method.

In some cases, it is possible to submit an order by fax or registered mail, if this method is provided for in the current agreement or contract. The depositary accepts and executes the order, and if execution is impossible, sends a report indicating the reasons for the refusal to the client.

The depositary can carry out transactions on certified and non-documentary securities that do not have physical form. Submission of instructions via remote communication channels is possible only for securities in documentary form, which include bonds and shares. Operations for accepting for storage and issuing from storage promissory notes, mortgages, savings and certificates of deposit are carried out only when the client personally contacts the depository.

Organization of the depository's work

Any depository has several divisions:

- operating room, which directly performs account operations;

- business development;

- on working with market infrastructure and issuers.

The operations department directly carries out clients' orders to carry out depository operations, carries out these operations and issues reports based on the results of their implementation. To directly carry out depository operations, employees who sign their signatures on reports must be certified as financial market specialists.

The essence of the business development division's work is to find new clients and establish correspondent relationships with other depositories. The competence of the development department often includes improving the technologies used and existing procedures.

The issuer relations department is responsible for direct communication with issuers, registrars, settlement depositories, and exchanges. As a result of contacts with them, the depository receives information about planned corporate events (redemption, conversion, redemption and splitting of various securities, holding meetings of shareholders, payment of dividends). For the necessary participation in meetings and payment of dividends, the depositary, at the request of issuers, compiles lists of owners of securities and sends them to issuers.