Functional cost analysis

This section discusses the issues of functional cost analysis (FCA) and functional management (FM).

The definition of the main terms is given and examples of the application of the FSA in various industries are given.

The concept of functional management is introduced, the relationship and differences between FSA and FU are analyzed.

Examples of application of functional control are presented.

Functional cost analysis (FCA) is a management tool, the emergence of which is associated with a change in the cost structure caused by the use of the latest equipment and technology in production processes. The use of the FCA allows you to more accurately distribute the costs associated with a particular product and type of activity of the organization, identify opportunities to reduce costs and improve the processes of the organization's functioning.

Functional cost analysis (Activity Based Costing, pronounced [Activity Base Costing]) is a methodology for measuring the cost and effectiveness of an organization, its resources and cost accounting objects (end elements of cost absorption).

The FSA concept is based on the premise that in order to produce and supply products or services, an organization needs to perform certain functions (business processes), which will require certain costs. In the FCA system, all costs that cannot be attributed directly to a product or service (indirect costs) are traceable to the business processes with which these costs are associated. The accumulated value of each business process is then traced back to the other functions, products or services associated with that function.

The cost factor is called cost bearer. By means of the cost carrier, a causal and quantitative relationship is established between the function, the costs incurred and the objects of cost accounting (types of products / services). The cost driver reflects the absorption of costs by business processes, and business processes reflect the absorption of costs by other functions or types of products / services.

For example, at a manufacturing plant, the following procedure has been established: according to the written out requirements for the release of materials, sets of materials are formed in the warehouse, which are then transferred to the workshop. Thus, the appearance of requirements for the release of materials causes the cost of forming kits. Therefore, in this example, the goods issue requirements will be treated as a cost object.

The following table shows several possible cost objects associated with different purchasing process functions.

Cost Object Examples

In some cases, the cost drivers for the FCA and the allocation basis for indirect costs for traditional costing methods may be the same, for example, for the function "Maintenance of machinery and equipment", the number of hours spent on maintenance can be used as a cost driver; for the "Quality control" function - the number of checks performed.

In contrast to FCA, traditional methods allocate costs to products based on unit attributes. Typical attributes of a unit of production are, for example: the number of man-hours of direct labor spent on the manufacture of a unit of production; number of machine hours; the volume of output; the purchase price of goods intended for subsequent sale; number of days of service. Thus, when allocating costs based on the use of traditional costing methods, there is a direct dependence of the amount of indirect costs on the volume of products manufactured, the cost of goods sold, or the time spent servicing the customer (for more details, see Shevchuk D.A. How to write a business plan: first step towards your business. - M.: AST: Astrel, 2008).

As an example, consider a manufacturing company that allocates indirect costs across products, using the time spent by key production workers as the base of allocation. Over the past few years, this company has additionally purchased several pieces of equipment, the use of which has made it possible to automate some of the manual labor and the cost structure of this company has changed - the share of time spent by the main production workers began to decrease, and the share of machine hours began to increase. This change shows that the time spent by the main production workers (man-hours) can no longer be considered as the correct basis for allocating indirect costs. However, simply switching to a different allocation base, ie machine hours, while a positive change in the costing system, is not the best solution. In such cases it may be expedient application functional cost analysis for a more accurate distribution of indirect costs between types of products. This manufacturing company needs to identify all activities carried out during the production process (for example, design and development; movement of raw materials, materials and semi-finished products around the enterprise; commissioning; product quality control, etc.), and then analyze and calculate the costs associated with the implementation of these activities (for example, wage, downtime, rent, energy costs, etc.). Then these costs must be allocated between types of products or between production lines, based on how much activity (volume of work) needs to be done to produce a particular type of product.

The FCA system can be viewed in two views: in the cost assignment view and in the process view. The cost assignment view provides information about resources, features, and cost objects (the vertical part of the example). Representation in the form of processes provides operational, including non-financial, information about functions (horizontal part of the example).

Two FSA submissions

Approaches to the FCA system, presented in the form of cost assignment, can be divided into two main categories: two-level approach and multilevel.

In the two-tier approach, the costs collected by type are allocated to the various functions in appropriate proportions using "first-tier" cost drivers. The costs accumulated by these functions are then allocated to the "second tier" cost drivers. For example, the costs of health insurance and electricity can be allocated to functions based on the number of people and hours of equipment operation as first-tier cost drivers. Costs accumulated in various functions can then be allocated to products based on second level cost drivers such as orders, machine hours, man hours, etc.

Two Tier Approach

A layered approach is used to more accurately reflect the actual movement of costs throughout the organization. In this case, the relationship between functions, as well as between functions and cost accounting objects, is at the forefront. With a multi-level approach, the path of costs from their places of origin to the objects of their accounting is traced not in two, but in several stages, each of which is based on a cause-and-effect relationship.

For example, the Maintenance and Tooling functions accumulate costs that are directly related to them. In accordance with the two-tier approach, second-tier cost objects are defined to allocate the costs of these functions among the cost objects. The layered approach recognizes that the Maintenance function is not directly related to cost accounting objects. It supports other features, including Tool Making, which is directly related to cost accounting objects and other features. The costs accumulated by these functions will be allocated either to cost accounting objects or to other functions based on the need for these functions, services or resources (for more details, see Shevchuk D.A. How to write a business plan: the first step to your business. - M.: AST: Astrel, 2008).

Layered Approach

Both two-level and multi-level approaches can be used to obtain information about the organization's resources, functions and cost accounting objects and to obtain data that make up the representation of the FSA as processes.

In connection with the use of high-tech equipment, automation of production at enterprises, the share of direct labor costs decreased, and the share of indirect costs, including the cost of technical equipment, the labor of non-production workers hired to operate them, increased and over time, the share of overhead costs in the total cost structure became very significant. However, costing systems have not been adapted to the changes that have taken place, resulting in a number of problems.

Many enterprises produce a very wide range of products. Some products are produced in large volumes (mass production), while others are produced in small volumes. The use of traditional costing methods leads to the fact that for those products that are produced in large volumes, in particular for those products whose production process is quite simple, more costs are charged than were actually incurred ( revaluation of costs). At the same time, those products whose production is carried out in small volumes, and in particular those whose production process is quite complex, are subject to a smaller amount of costs than was actually incurred ( cost underestimation).

As a result, after allocating indirect costs between types of products using traditional costing methods, the enterprise receives distorted data on the cost of these types of products. The traditional costing system allocates indirect costs between products using one (sometimes several) distribution factor(s), which is based on the volume of output in physical terms.

In cases where an enterprise produces many types of products and the share of indirect costs in total costs is significant, and also when factors other than volume of production give rise to these costs, there is a high degree of probability that the cost of these types of products will be distorted. This distortion is due to the fact that costing is calculated using the traditional costing method.

The development of functional cost analysis in the mid-80s was the main solution to the problems that arose in connection with the use of the traditional method of costing in industries with a wide range of manufactured (sold) products.

Initially, the FCA method was used to more accurately allocate indirect production costs to cost objects (types / units of output), but soon after its application, it was found that using this method provides many other advantages. For example, one such advantage is that the range of allocable costs can be expanded to include non-manufacturing costs, which is very important for developing pricing policy companies.

In the early 90s, it became obvious to most managers that the management accounting system is not only a mechanism for calculating the cost, but also a logical conceptual basis for managing the activities of an enterprise by analyzing its main characteristics, such as cost factors and performance indicators.

As noted earlier, the automation of the production process, as well as the expansion of the range of products, leads to the fact that in the structure of production costs of companies there is an increase in the share of indirect costs and a decrease in the share of direct costs.

Under such circumstances, the use of traditional costing methods can lead to distortions in the value of the cost of goods produced.

Managers of those companies in which issues related to the cost of production occupy a significant place in the process of decision-making, planning and control, may experience great difficulties due to the fact that the information obtained through the use of the traditional costing method is inadequate to their information needs to make sound economic decisions.

For such companies, the transition to the use of FSA would be the best solution to this problem. However, a decision on whether to use this method should only be taken after a careful assessment of the costs and benefits associated with switching to a new method.

Let INTERFINANCE apply in one of its stores a costing system with one direct cost category (goods purchased for sale) and one indirect cost category (store maintenance). Below is a diagram of the distribution of costs of the company "INTERFINANCE".

Cost Object Examples

Store maintenance costs are charged to goods at the rate of 30% of the cost of goods. For example, for coffee worth 63 rubles. include indirect costs of 18.9 rubles. (63 x 30%). The table shows the profitability of a product line (a group of similar products) with this costing method. The cost of goods purchased for subsequent sale is up to 76.92% of total costs (1,000,000 rubles: 1,300,000 rubles). In terms of the ratio of operating profit to revenue, product lines will line up in the following order: (1) fresh products (7.17 %); (2) packaged foods (3.30%); and (3) soft drinks (1.70%).

Profitability of product lines in the company I NTERFINANCE" according to the previous costing system is presented in the table.

INTERFINANCE Monthly Profitability Report

The organization decided to expand the store. In this regard, accurate information on the profitability of individual product lines is needed: the existing data on the profitability of product lines are based on averaging the cost of maintaining a store. Store performance research shows that individual product lines use organizational resources differently.

To calculate the cost of product lines, it was decided to apply the FSA method. After the analysis of operations and information systems, the following amendments were made to the costing methodology.

1. Identification of direct costs. Another category of direct costs has been introduced: the return of bottles. The category applies only to the soft drink line; previously included in the center of indirect costs for the maintenance of the store.

2. Indirect cost centers and cost distribution bases. Instead of one category of indirect costs for maintaining the store, cost centers representing four types of activities are selected. Cost carriers have been defined, which will later become the basis for the distribution of costs.

Custom products. The cost driver is the number of orders for the supply of goods. In 2003, the actual costs amounted to 1,000 rubles. to order.

Delivery includes physical delivery and acceptance of marketable products. The cost driver is the number of deliveries. In 2003, the actual supply costs amounted to 800 rubles.

Display of goods on the sales floor includes moving goods to the trading floor and placing them on shelves, showcases, etc. Cost carrier - hours of product layout. In 2003, the actual costs were 200 rubles. at one o'clock.

Help for clients includes work with clients, including cash control and hanging goods. The cost driver is the number of units sold. In 2003, the actual costs amounted to 2 rubles. for each unit sold.

Scheme of distribution of costs of the company "INTERFINANCE" according to the FSA system

INTERFINANCE received the following data for December 20__.

Total number of cost objects

According to the above data, the profitability of product lines was calculated using the FSA system.

INTERFINANCE monthly profitability report for December 20__ according to the FSA system

Functional cost analysis is more accurate than the previous costing system: it more clearly distinguishes between the activities of the organization and reflects the use of resources by individual product lines. The ranking of the relative profitability (percentage of operating income to revenue) of the three product lines in the old costing system and in the FSA system is as follows:

Comparison of the relative profitability of INTERFINANCE product lines

The ratio of revenue, cost of goods for sale and costs by type of activity for product lines are shown in the table. Non-alcoholic beverages are the least resource intensive, with fewer imports and fewer restockings than for fresh or packaged foods. Most beverage vendors deliver products to store shelves and stack them themselves. In contrast, fresh produce accounts for the most deliveries and takes a long time to replenish. The number of units sold here is also the highest. The old costing system was based on the assumption that all product lines use resources in proportion to the ratio of the individual cost of selling a given product to the total cost of selling. Such an assumption is incorrect.

The ratio of revenue, cost of goods for sale and costs by type of activity for product lines

FSA data can help the management of INTERFINANCE make a decision on the distribution of additional retail space. For example, there will be more space for drinks. However, FSA data should be only one of the factors in deciding on the distribution of retail space.

INTERFINANCE MV LLC assembles and tests more than 80 electronic printed circuit boards. Various parts (diodes, capacitors, integrated circuits) are mounted on each board. The company uses an order-based costing system. Consider the old costing system and the changes caused by the introduction of the FSA for more exact definition production cost.

The basis of the former order-based costing system at LLC INTERFINANCE MV consists of two categories of direct costs and two centers of indirect production costs.

Direct production costs:

Direct material costs

Direct Labor

Indirect production costs:

Supply (purchase) - refers to the goods in the amount of 40% of direct material costs

The existing costing system uses actual costs for two categories of direct costs and estimated data for two categories of indirect costs. The table shows the costing of printed circuit boards X and Y according to the current costing system. The general scheme of order costing is shown in the figure below.

Calculation of the cost of production of goods for 20__

Order-by-order costing scheme

When such a costing system is used, these systems do not reflect differences in the use of resources by different products. For example: when using the part "capacitor" worth 0.20 rubles. indirect costs associated with the supply are 0.08 rubles, and in the case of a coprocessor at a price of 100 rubles. they are equal to 40 rubles, while the purchase and delivery of a coprocessor does not require 500 times more resources (40 rubles: 0.08 rubles = 500) than for a capacitor.

Costs for different types activities are determined by different factors, but the costing system does not provide information about these differences. The costing system tends to inflate the cost of popular mass goods such as X board. The reason is that there are too many indirect production costs for mass goods and too few for small-scale goods.

Cost correction with the help of FSA

Step 1: The work order is selected as a cost object. In INTERFINANCE MV LLC, an order is considered to be an order of any size for the manufacture of one or more of 80 different printed circuit boards of the production nomenclature.

Step 2: Determination of the direct costs for the order. In the revised costing system of INTERFINANCE MV, two existing categories of direct costs have been retained: direct material costs and direct labor costs.

Step 3: Determination of indirect cost centers for the order. There are five indirect cost centers in the adjusted system. These indirect cost centers represent the types of production activities of INTERFINANCE MV LLC.

1. Material processing. Complete with all the parts necessary for the production of printed circuit boards.

2. Automatic installation. Automatic and semi-automatic devices install parts on the board.

3. Manual installation. Skilled workers mount parts that automation cannot install (due to shape, weight, position on the board, etc.).

4. Wave soldering. All installed parts are fixed simultaneously with a wave of solder.

5. Quality control. Testing checks that all components are installed, in the right places, and that the finished product meets specifications.

Step 4: Select a cost allocation base to allocate all indirect costs to jobs. Guided by the fundamental for the FSA principle of a causal relationship between the performance of individual functions and the occurrence of costs, cost carriers were identified. The FSA Implementation Project Team interviewed technicians, reviewed the operation of the plant, and analyzed data for each area of activity. The selected cost drivers and their rates are presented in Step 5.

Step 5: Numerical evaluation of all cost drivers to allocate indirect costs per order. Consider the indirect costs of automatic assembly of parts. In 2003, the total costs of this activity reached 20 million rubles. The number of automatically mounted parts in 2003 amounted to 4 million pieces. Thus, the rate of indirect costs for automatic installation is 5 rubles. per part (20 million rubles: 4 million parts). A similar procedure is used to calculate each of the following 2003 overhead cost allocation rates for all functions. The actual rates of the final distribution are presented in the table.

Cost Carriers and Their Rates

The following table shows the calculation of the cost of printed circuit boards X and Y according to the FSA system, taking into account the actual quantitative data for the enterprise.

Calculation of the cost of production of goods for 20__ according to the FSA

The new cost allocation scheme in accordance with the FSA is shown in the figure.

Costing scheme according to the FSA method

Increasing the number of indirect cost centers to five resulted in greater accuracy in cost allocation. For example, in the field of quality control, the costs are based on hours of testing, and the cost of automatic installation of parts is measured by a different unit (parts automatically installed), which gives a more adequate estimate of the cost.

FSA gives a cost reduction of 11.9% for payment X in comparison with the cost of 11,280 rubles. in the previous system: (9,940 rubles - 11,280 rubles) / 11,280 rubles = -11.9%. On the contrary, there is an increase of 24.8% in the payment of Y in the Federal Antimonopoly Service - compare with the cost of 8,950 rubles. in the previous system: (11,180 rubles - 8,960 rubles) / 8,960 rubles. = 24.8%.

Functional cost analysis allows to give a number of recommendations to INTERFINANCE MV.

1. From the difference in the cost of X and Y boards according to the FSA, it can be seen how differently these products absorb resources in all types of activities. Consider the difference in resource use across four of the five activities.

Comparison of Resource Usage in PCB Manufacturing

The FCA costing is more accurate than the old system and provides cost figures that more clearly reflect differences in the use of enterprise resources in processing, production, quality control, etc. These differences help to see how much in the old costing system the cost of board X was overstated, and board Y underestimated. The marketing department can lower the price of the X fee and still make a reasonable profit. Due to inaccurately calculated cost, and hence incorrectly set prices, the company could lose market share of this mass product.

2. The FSA system indicates opportunities for cost reduction. Management may ask why the X board is cheaper? The FSA cites three reasons:

a) board X has fewer parts;

b) in board X, more parts are installed automatically (this is cheaper than manually);

c) the quality control of board X takes less time.

Functional cost analysis clearly shows that points a), b) and c) lead to a reduction in the cost of assembling a printed circuit board. Indeed, X is a standard board that INTERFINANCE MV LLC produces on a mass scale.

3. The FSA system better coordinates the efforts of the production department of INTERFINANCE MV LLC aimed at reducing costs. The five activities are measured by different indicators. You can now set cost reduction targets related to unit cost reduction in each activity. For example, a foreman in a material handling area could be given a target to keep the processing costs under $20. for detail. Note that each of the indirect cost allocation bases in the FCA system is a non-financial variable (number of parts, inspection hours, etc.). Often, for manufacturers, controlling physical items such as watches or parts is a fundamental way to manage costs.

In any costing system with planned indirect cost rates at the end of the period, the question arises of clarifying under- or over-allocated indirect costs.

In LLC INTERFINANCE MV, for example, there is a planned cost rate for each of the five types of activities: these are indirect costs for the manufacture of printed circuit boards. Under- and reallocated costs can occur in any activity. A number of adjustment entries may be required to adjust these costs at the end of the accounting period.

If the purpose of the adjustment at the end of the period is to clarify the cost of a particular product, then for under- and reallocated costs by activity, the method of the adjusted allocation rate should be applied if it is economically justified.

If the purpose of the adjustment at the end of the period is the desire to more accurately account for inventories and costs of sale, then proportional allocation (based on activity costs attributed to products) is quite sufficient. In the case of INTERFINANCE MV, this apportionment would include the materials component from inventory at the end of the period.

The reason for this is that the indirect costs of processing materials are shared among all materials. The under- or reallocation of indirect costs of processing these materials requires an adjustment entry at the end of the period for all three components of period-end inventory (materials, work in progress, finished goods), as well as for the cost of selling products.

The transition from the traditional method of costing to the method of functional cost analysis will be most beneficial in cases where one or more of the following statements are true:

The share of indirect costs is significant in the total cost, and most of the indirect costs are not directly related to the volume of output;

The company has a wide range of products and the amount of costs actually absorbed by each type of product differs from the amount of costs attributed to them using the distribution ratio. This ratio is calculated using the cost factors associated with the volume of output;

Various types of products are produced in different volumes. Also, depending on the type of product, the level of complexity of the production process varies;

The decisions made by the company's management are ineffective as a result of the fact that the information provided on the cost of manufactured products is unreliable;

The costs required for the development, implementation and support of the functional cost analysis system will be relatively low due to the fact that the company has modern software and relevant specialists.

The advantages of using this calculation method can be as follows:

More accurate calculation of the cost of manufactured products;

The ability to calculate the cost of performing work and providing services by internal divisions of the company (performance of work / provision of services by one division to another);

Ability to assess the costs associated with customer service;

A more accurate assessment of the costs associated with the implementation of a particular project;

The ability to determine which direction of the company's activities requires additional efforts in terms of management and development;

The information obtained by using this costing method is very useful for performing a company's Economic Value Added Analysis (EVA);

As a result of the formation of more reliable information about the cost of manufactured products, the management of companies has the opportunity to make more correct decisions, which as a result leads to an increase in the efficiency of the company.

As problematic issues associated with the use of this method of costing, for example, the following can be cited:

expenses Note: The cost of implementing an FCA system can be significant and can be a hindrance to a business that has just made a major investment in modern manufacturing equipment. However, experience shows that the costs of moving from a traditional costing system to a functional cost analysis at such enterprises are usually offset by improving the cost control system and obtaining timely and reliable information on the cost of manufactured products, which helps the management of enterprises in making the most effective economic decisions (in including the loading of this equipment);

indirect costs: for the FSA method, as well as for other costing methods, it remains a problem to determine the appropriate distribution base for indirect production costs to cost objects (types / units of production). The problem arises because, by definition, indirect costs can be caused by non-identifiable cost drivers and are not directly related to specific cost objects. Therefore, when choosing cost drivers, a balanced approach is needed to determine their adequacy;

level of detail: the use of FSA requires more detailed analysis costs and reporting them than with the traditional system. The level of complexity of this system can increase if it is used not only for the purpose of calculating the cost of products manufactured, but also for the purpose of implementing functional management, since in order to carry out such management, the company's management needs more extensive and detailed analysis both costs and business processes.

FUNCTIONAL CONTROL

Functional Management (Activity Based Management, pronounced [Activity Base Management]) is a method of making management decisions based on information received from the FSA system, in order to analyze the effectiveness of various activities, reduce costs, optimize business processes, and achieve the strategic goals of the enterprise.

It is necessary to avoid confusion of concepts, which sometimes arises in relation to functional cost analysis and functional management. The relationship between functional cost analysis and functional management, as well as the differences between their goals and objectives are presented in the table.

Relationship and differences between FSA and FU

Functional management does not replace, but complements existing management methods, creating the possibility of accounting, measuring results and determining the priorities of the enterprise.

APPLICATION OF FUNCTIONAL CONTROL

Functional management is associated with a whole range of actions that can be taken based on the qualitative information obtained through the use of the FSA. The reasons for introducing functional management may be the need to optimize the decision-making process, improve performance, obtain a higher level of income from the assets used.

Examples of practical applications of FM in an organization are attributive analysis, strategic analysis, performance benchmarking, operational analysis, profitability/pricing analysis, and process improvement.

Attribute analysis is a method of classifying and grouping data according to costs and benefits. FSA/FM systems may use different data attributes for individual costs. Data attributes allow an organization to perform analysis in various aspects of management problems based on the creation of a simple data warehouse, for example, using OLAP systems. Forms of attribute analysis include:

cost analysis: this method uses information about business processes and examines the attributes of the processes to identify possible ways to improve the efficiency of processes;

analysis of temporary changes: this method examines the time required to perform the function, and determines ways to minimize these costs;

quality cost analysis: this method is used to prepare and present management information on quality assurance costs. Costs are determined and evaluated based on the use of the following categories: prevention of marriage; detection of marriage; problems caused internal factors; problems caused by external factors.

Strategic Analysis is a method of identifying different ways to create competitive advantage in the market for the organization. Strategic analysis allows you to determine how to influence future costs and improve the future profitability of the organization by determining the value of various cost accounting objects, such as products, customers, distribution channels. Combinations of natural and financial indicators are created to study the impact of alternative strategic positions.

Comparative analysis of indicators- this is a method for determining benchmark indicators for a function and then comparing them with indicators of the same type of functions. This method is used to identify a process or technology that could improve the efficiency or performance of a function. Within the framework of functional management, the following types of comparative analysis are supported:

Comparison with internal benchmarks;

Comparison with industry benchmarks and competitors;

Comparison with the best benchmarks of enterprises in the same industry.

Operational Analysis is a method of identifying, measuring and improving current results on key processes and operations within an organization. The functional management system is useful for performing, for example, the following types of operational analysis:

Analysis "what if";

Analysis of the effectiveness of project management;

Analysis of the use of production capacities;

Analysis of restrictions (limiting factors).

Profitability/pricing analysis is a key objective of any organization. FM assists an organization in conducting cost-benefit analysis by product and process, both in terms of “as is” scenarios and for making improvements in “as should be” scenarios. Tasks in adapting an organization to changes in the competitive environment for which FI can be useful include:

Profitability analysis of products/services;

Profitability analysis of market segments;

Costing life cycle product and target costing.

Process improvement underlies all modern management techniques. Using the results of the functional cost analysis, determining the lack of efficiency in the use of consumed resources, process improvement is aimed at achieving both quantitative and qualitative changes in the organization's activities to increase overall efficiency. The following are areas for applying FM to improve processes:

Modeling of business processes;

Integrated quality assurance initiatives;

Reasonable change in business processes;

Analysis of the possibilities of some production functions beyond the scope of production activities and shared services.

BENEFITS OF FUNCTIONAL CONTROL

FU is used to support a wide range management tasks that help organizations increase the value they create for their customers while reducing the cost of operations. The main benefits that an organization receives when applying FI include:

identification of excess costs;

analysis of useful and useless costs;

element-by-element determination of costs for quality assurance;

identification of functions related to servicing customers (customers of the company);

analysis of costs by levels of complexity of production of various types of products;

analysis of the effectiveness of the activities carried out by the company;

forecasting and assessing the impact of reorganization decisions;

improved understanding of the structure of cost drivers;

functional budgeting.

FAULTS OF FUNCTIONAL MANAGEMENT

The disadvantage of functional management is the fact that it cannot be applied without the introduction of a system of functional cost analysis. It also requires a rethinking of the mindset of accounting personnel.

| |

Functional cost analysis (also sometimes called activity costing) is a cost accounting model (Figure 1). It is designed to allocate all costs to separate categories based on the time spent on activities that are associated with the production of goods and the provision of services to consumers.

In traditional cost accounting models, indirect costs (overheads) are distributed in proportion to the volume of production. As a result, products that are produced in large quantities tend to be overpriced, while goods and services that are produced in small quantities tend to be underpriced. Unlike traditional cost accounting methods, when using the functional cost analysis (FCA) model, the real costs associated with goods, consumers or services are determined, for which indirect costs are allocated by type of product not on the basis of volume, but on the basis of required or actually performed types. activities.

Instead of using arbitrary percentages, which is often found in traditional cost accounting methods, the focus of the FCA is on identifying cause-and-effect relationships in order to objectively allocate costs on their basis. After the costs for individual activities are determined, the costs for each such type are allocated to all products, depending on the extent to which this type of activity was used in the production of a particular product or in the provision of a particular service. With this approach, the FCA often helps to identify areas with high overhead costs per unit of output and, through this, try to find ways to reduce them or charge more. large sums for products that are expensive to manufacture.

The FCA model is based on the following basic assumption: costs arise not from products or consumers per se, but from the performance of the activities that were required to produce goods or provide services. Since to create different products different types of activities are needed, each of which also requires a different resource provision, when allocating total costs for certain types of goods and services, it is necessary to use weighting coefficients correctly.

When making decisions, knowing the real costs helps:

- set economic break-even points;

- identify those consumers who make a profit and those on whom the company incurs losses (i.e., evaluate the "value of the consumer");

- identify opportunities for improvement;

- compare investment alternatives.

When to Apply the Model

FSA can be useful when company overheads are high and when multiple combinations of products and customers increase complexity and handling costs. This method of cost accounting allows you to convert indirect costs to direct costs. As a more accurate cost management system, FCA identifies opportunities to increase efficiency and improve the results of business processes, which is facilitated by knowing the real costs associated with the production of goods and the provision of services.

There are other models similar to the FSA. These are, in particular, the total cost of ownership (TCO) model and the cost model throughout the product life cycle. When applying TCO, the total cost of investment is calculated, including one-time purchases, recurring costs and operating costs. This concept is very widely used in the implementation of projects related to information technology, where it is difficult to quantify their benefits, and therefore the main focus in this case is on minimizing project costs. Life cycle cost analysis allows you to determine the total costs over the entire life of the product (from its development to disposal).

How to use the model

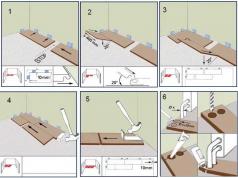

FSA in a simplified form consists of five steps.

- Determine the objects of accounting and non-core activities and the resources needed to carry them out.

- Determine the cost per non-core activity.

- Set cost factors for each resource.

- Calculate the total indirect costs associated with the product, broken down by accounting items.

- Divide the total costs into parts equal to the indirect costs attributed to individual accounting items.

As an object of accounting, goods, consumers, services can be selected. And the type of activity can be everything that a company does in running its business: receives raw materials, performs loading operations, packs goods, makes calls, gives explanations, deals with sales and purchases, promotes its products, makes calculations and performs calculations, places orders, receives orders, etc. A non-core activity is one whose costs cannot be directly attributed to accounting objects. Resources can be machinery and equipment, computers, people and any other facilities or assets that can be (at least partially) attributed to a particular type of activity.

conclusions

FSA allows for segmentation of costs based on real profitability, which helps to more accurately assess customer value. In this capacity, the application of this model is the first step towards the use of process-oriented management or, as it is also called, activity-based management. The FSA does not evaluate the effectiveness or productivity of activities, although knowing these indicators can be very important for business improvement. It should also be noted that the FSA is carried out on the assumption that it is possible to identify unique accounting objects, activities and resources. Ultimately, however, the accuracy of the results of this analysis depends on the accuracy of the underlying data on which it was based.

Functional cost analysis(FSA, Activity Based Costing, ABC) - a method for determining the cost and other characteristics of products, services and consumers, using as a basis the functions and resources involved in production, marketing, sales, delivery, technical support, provision of services, customer service, and also quality assurance.

Functional cost analysis allows you to perform the following types of work:

Definition and implementation general analysis the cost of business processes at the enterprise (marketing, production and provision of services, sales, quality management, technical and warranty service, etc.);

Holding functional analysis associated with the establishment and justification of the functions performed by the structural divisions of enterprises in order to ensure the release of high quality products and the provision of services;

Identification and analysis of basic, additional and unnecessary functional costs;

Comparative analysis of alternative options for reducing costs in production, marketing and management by streamlining functions structural divisions enterprises;

Analysis of the integrated improvement of enterprise performance.

The FCA method is a comprehensive tool for evaluating systems, processes and concepts.

The FCA method is designed as an "operations-oriented" alternative to traditional financial approaches. In particular, unlike traditional financial approaches, the FSA method:

Provides information in a form understandable for the personnel of the enterprise directly involved in the business process;

Allocates overheads according to a detailed calculation of the use of resources, a detailed understanding of the processes and their impact on cost, and not on the basis of direct costs or accounting for the full volume of output.

The FSA method is one of the methods that allows you to point out possible ways to improve cost indicators. The purpose of creating a FSA-model for improving the activities of enterprises is to achieve improvements in the work of enterprises in terms of cost, labor intensity and productivity. Carrying out calculations according to the FSA model allows you to obtain a large amount of FSA information for making a decision.

The FSA method is based on data that provide managers with the information necessary to justify and make management decisions when applying methods such as:

"just in time" (Just-in-time, JIT) and KANBAN;

Chapter 6. Structures and processes for effective management

Global Quality Management (TQM);

Continuous improvement (Kaizen);

Reengineering of business processes (Business Process Reengineering, BPR).

The FSA concept allows presenting management information in the form of financial indicators. Using simply US$ or RUB as the units for measuring financial indicators, the FSA method displays the financial condition of the company better than traditional accounting does. This is because the FCA method reflects the functions of people, machines and equipment, the level of resource consumption by functions, and the reasons why these resources are used.

The use of FSA is much broader than the task of forming business processes.

FSA-information can be used both for current (operational) management and for making strategic decisions. At the level of tactical management, information from the FSA model can be used to form recommendations for increasing profits and improving the efficiency of the organization. At the strategic level, assistance in making decisions regarding the reorganization of the enterprise, changing the range of products and services, entering new markets, diversification, etc. FSA-information shows how resources can be redistributed with maximum strategic benefit, helps maintenance, cost reduction, labor intensity reduction) that matter most, and to determine the best options investment.

Performance improvement includes three stages: at the first stage, the analysis of functions is carried out to identify opportunities for improving the efficiency of their implementation; on the second - the causes of unproductive expenses and ways to eliminate them are identified; the third is monitoring and accelerating the desired changes by measuring key performance parameters.

With regard to reducing cost, labor intensity and time, using the FSA method, it is possible to reorganize activities in such a way that a sustainable reduction is achieved. To do this, do the following:

Reduce the time required to perform functions;

Eliminate unnecessary features;

Form a ranked list of functions by cost, labor intensity or time;

Select functions with low cost, labor intensity and time;

Organize the sharing of all possible functions;

Reallocate resources freed up as a result of improvements.

I. I. Mazur, V. D. Shapiro, N. G. Olderogge. Effective management

Obviously, the above actions improve the quality of business processes. Improving the quality of business processes is carried out by conducting a comparative assessment and choosing rational (according to cost or time criteria) technologies for performing operations or procedures.

Function-based management is based on several analytical methods that use FSA information. These are strategic analysis, cost analysis, time analysis, labor intensity analysis, determination of target cost and calculation of cost based on the life cycle of a product or service.

One of the ways in which the principles, tools and methods of the FSA are used is function-based budgeting to determine the scope of work and resource requirements. There are two ways to use it:

Selection of priority areas of activity linked to strategic goals;

Development of a realistic budget.

FSA-information allows you to make conscious and purposeful decisions about the allocation of resources, based on an understanding of the relationship between functions and cost objects, cost factors and the amount of work.

In the process of constructing functional cost models, it was possible to establish a methodological and technological relationship between IDEF0 and FSA models.

The connection of the IDEF0 and FSA methods lies in the fact that both methods consider the enterprise as a set of sequentially performed functions, and the arcs of inputs, outputs, controls and mechanisms of the IDEFO model correspond to the value objects and resources of the FSA model. The correspondence is:

Resources (costs) in the FSA model are input arcs, arcs of control and mechanisms in the IDEFO model;

The products (value objects) of the FSA model are the output arcs of the IDEFO model, and the actions of the FSA method are functions in the IDEFO model.

At a lower level (functional block level), the connection between IDEF0 and FSA models is based on three principles:

1. A function is characterized by a number that represents the cost or time it takes to complete that function.

2. The cost or time of a function that has no decomposition is determined by the system developer.

3. The cost or time of a function that has a decomposition is calculated as the sum of the costs (times) of all subfunctions at a given level of decomposition.

Functional cost analysis

The essence of the method

Functional cost analysis (FSA, A activity B settled C osting, ABC) is a technology that allows you to evaluate the real value of a product or service, regardless of the organizational structure of the company. Both direct and indirect costs are allocated to products and services depending on the amount of resources required at each stage of production. The actions performed at these stages, in the context of the FSA method, are called functions (activities).

The purpose of the FSA is to ensure the correct allocation of funds allocated for the production of products or the provision of services, according to direct and indirect costs. This allows for the most realistic assessment of the company's costs.

Essentially, the FSA method works according to the following algorithm:

- Does the market dictate the price level or is it possible to set the price of products that will give the planned profit?

- Should the projected premium on FSA costs be applied equally across all operations, or do some functions generate more revenue than others?

- how does the final selling price of products compare with FSA indicators?

Thus, using this method, you can quickly estimate the amount of profit expected from the production of a particular product or service.

If the original cost estimate is correct, then income (before taxes) will be equal to the difference between the selling price and the costs calculated using the FCA method. In addition, it will immediately become clear which products or services will be unprofitable (their selling price will be lower than the estimated costs). Based on this data, you can quickly take corrective actions, including revising business goals and strategies for the coming periods.

Reasons for the appearance of FSA

The FSA method appeared in the 80s, when traditional methods of cost calculation began to lose their relevance. The latter appeared and developed at the turn of the last and the century before last (1870 - 1920). But since the early 1960s, and especially in the 1980s, changes in the way we manufacture and do business have led to traditional cost accounting being labeled "enemy number one for manufacturing" because its usefulness has become highly questionable.Traditional cost estimation methods were originally developed (according to GAAP standards based on the principles of "objectivity, verifiability and significance") for the evaluation of inventories and were intended for external consumers - creditors, investors, the Securities Commission ( S economy E xchange C ommission), Internal Revenue Service ( I internal R evening S service).

However, these methods have a number of weaknesses, especially noticeable in internal management. Of these, the two biggest drawbacks are:

- The impossibility of accurately conveying the costs of producing a particular product.

- Failure to provide feedback– information for managers necessary for operational management.

As a result, managers of companies selling various types of products make important decisions regarding pricing, product combination and production technology, based on inaccurate cost information.

So decide contemporary issues Functional cost analysis was called upon, and it ended up being one of the most important innovations in management in the last hundred years.

The developers of the method, Harvard University professors Robin Cooper and Robert Kaplan, identified three independent, but in concert, factors that are the main reasons for the practical application of the FSA:

- The process of structuring costs has changed very significantly. And if at the beginning of the century labor was about 50% of total costs, the cost of materials - 35%, and overheads - 15%, now overheads are about 60%, materials - 30%, and labor - only 10% of production costs. . It is obvious that using working hours as a cost allocation base made sense 90 years ago, but with the current cost structure it has already lost its force.

- The level of competition that most companies face has increased tremendously. “A rapidly changing global competitive environment” is not a cliché, but a very real nuisance for most firms. Knowing the actual costs is very important to survive in such a situation.

- The cost of performing measurements and calculations has declined as information processing technologies have advanced. Even 20 years ago, the collection, processing and analysis of the data needed for the FSA were very expensive. And today, not only special automated data evaluation systems are available, but also the data itself, which, as a rule, has already been collected in one form or another and stored in each company.

In this regard, the FSA can be a very valuable method, since it provides information on the full range of operational functions, their cost and consumption.

Difference from traditional methods

Under traditional financial and accounting methods, a company's performance is valued by functional operations rather than by services provided to the customer. The calculation of the effectiveness of a functional unit is made according to the execution of the budget, regardless of whether it benefits the client of the company. In contrast, functional cost analysis is a process management tool that measures the cost of performing a service. The assessment is carried out both for functions that increase the value of a service or product, and taking into account additional functions that do not change this value. If traditional methods calculate the costs of a certain type of activity only by categories of expenses, then the FSA shows the cost of performing all process steps. FSA explores all possible functions in order to determine the most accurate cost of providing services, as well as to ensure the possibility of upgrading processes and increasing productivity.

Here are three main differences between FSA and traditional methods (see Figure 1):

- Traditional accounting assumes that cost objects consume resources, while in FSA it is assumed that cost objects consume functions.

- Traditional accounting uses quantitative indicators as the basis for allocating costs, while FSA uses sources of costs at various levels.

- Traditional accounting is focused on the structure of production, while the FSA is focused on processes (functions).

Rice. 1. Main differences between FSA and traditional cost accounting methods

The direction of the arrows is different, as the FSA provides detailed information about the processes for cost estimation and performance management at multiple levels. And traditional cost accounting methods simply allocate costs to cost objects, without taking into account cause and effect relationships.

So traditional cost accounting systems focus on the product. All costs are attributed to the product, since it is believed that the manufacture of each element of the product consumes a certain amount of resources proportional to the volume of production. Therefore, the quantitative parameters of the product (working time, machine hours, cost of materials, etc.) are used as cost sources for calculating overhead costs.

However, quantitative indicators do not allow taking into account the diversity of products in terms of size and complexity of manufacture. In addition, they do not reveal a direct relationship between the level of expenditure and the volume of production.

The FSA method uses a different approach. Here, the costs of performing individual functions are first determined. And then, depending on the degree of influence of various functions on the manufacture of a particular product, these costs are correlated with the production of all products. Therefore, when calculating overhead costs, functional parameters such as equipment setup time, number of design changes, number of processing processes, etc. are taken into account as cost sources.

Consequently, the more functional parameters there are, the more detailed the production chain will be described and, accordingly, the real cost of production will be more accurately estimated.

Another important difference between traditional cost estimation systems and the FSA is the scope of functions. In traditional inventory valuation methods, only internal production costs are tracked. The FSA theory does not agree with this approach, believing that when calculating the cost of a product, all functions should be taken into account - both those related to supporting production and the delivery of goods and services to the consumer. Examples of such functions include: production, technology development, logistics, product distribution, service, information support, financial administration and general management.

Traditional economic theory and financial management systems consider costs as variables only in the case of short-term fluctuations in production volumes. Value-for-money theory suggests that many important price categories also fluctuate over long periods (several years) as the design, composition, and range of a company's products and customers change.

Table 1 compares the FSA and traditional cost accounting methods.

Table 1. FCA and Traditional Cost Accounting Methods

|

Traditional Methods |

Explanation |

|

|

Feature Consumption |

Resource consumption |

Traditional accounting methods are based on the assumption that prices can be controlled, but as the practice of most managers has shown, this is practically impossible. The theory of functional cost analysis recognizes that only what is produced can be controlled, and prices change as a result. The advantage of the FSA approach is that it provides a wider range of measures to improve business performance. In a systematic study of the functions performed, not only the factors affecting the increase or decrease in productivity are revealed, but also the incorrect distribution of resources is detected. Therefore, in order to reduce costs, it is possible to rationally allocate power and achieve higher productivity than in the traditional way. |

|

Sources of costs at different levels |

Quantitative cost allocation bases |

As overhead costs rise, new technologies emerge, and of course, allocating costs based on 5-15% (as in most companies) of all total costs is too risky. In fact, errors can reach several hundred percent. In functional cost analysis, costs are distributed in accordance with cause-and-effect relationships between functions and cost objects. These links are fixed with the help of cost sources. In practice, the sources of costs are divided into several levels. Here are the most important ones: Unity level. At this level, sources are considered for each unit of output produced. For example: a person and a machine that produce a product per unit of time. The corresponding working time will be considered a cost source for the unit level. This is a quantitative measure similar to the cost allocation basis used in traditional accounting methods. Batch level. These sources are no longer associated with units, but with batches of products. An example of using the functions of this level would be production planning, which is carried out for each batch, regardless of its size. A quantitative indicator of such sources is, as a rule, the number of parties. Product level. Here we are talking about sources related to the release separate species products, regardless of the number of units and batches produced. As an indicator, for example, the number of hours required to develop a product is used. The higher this indicator, the greater the costs allocated to this product. Enterprise level. Sources of this level are not directly related to products, these are general functions related to the operation of the enterprise as a whole. However, the costs they cause are allocated later on by product. |

|

Process orientation |

Structural Orientation |

Traditional costing systems focus more on the organizational structure than on the existing process. They cannot answer the question: “What should be done?”, because they do not know anything about the process. They have only information about the availability of resources needed to do the job. And the process-oriented method of the FCA gives managers the opportunity to most accurately match resource requirements and available capacities, and therefore increase productivity. |

FSA application. Example

Mispricing of products occurs in almost all companies involved in the production or sale of a large number of goods or the provision of various services. To understand why this happens, consider two hypothetical factories that produce simple items - ballpoint pens. Factory #1 produces a million blue pens every year. Factory #2 also produces blue pens, but only 100,000 a year. In order for production to operate at full capacity, as well as to ensure the employment of personnel and extract the necessary profit, plant No. 2, in addition to blue pens, produces a number of similar products: 60 thousand black pens, 12 thousand red pens, 10 thousand purple pens, etc. Usually, plant No. 2 produces up to a thousand different types of goods per year, the volumes of which range from 500 to 100 thousand units. So, the total output of plant No. 2 is equal to one million items. This value coincides with the volume of production of plant No. 1, so they require the same number of labor and machine hours, they have the same material costs. However, despite the similarity of goods and the same volume of production, an outside observer can notice significant differences. Plant #2 has more staff to support production. There are employees involved in:

- equipment management and configuration;

- checking products after setting;

- receiving and checking incoming materials and parts;

- movement of stocks, collection and shipment of orders, their fast forwarding;

- processing of defective products;

- design and implementation of design changes;

- negotiations with suppliers;

- planning the receipt of materials and parts;

- modernization and programming of a much larger (than the first plant) computer information system).

Plant #2 has higher rates of downtime, overtime, warehouse overload, rework, and waste. A large workforce supporting the production process, as well as a general inefficiency in the production technology of products, leads to a discrepancy in prices.

Most companies calculate the cost of running such a production process in two stages. First, the costs associated with certain categories of responsibility (responsibility centers) are taken into account - production management, quality control, receipts, etc. - and then these costs are associated with the relevant departments of the company. Many firms are very good at implementing this stage. But here's the second step, where the costs of the divisions should be distributed to specific products, is performed too simplistic. Until now, working hours are often used as the basis for calculation. In other cases, two more additional bases are taken into account for calculation. Material costs (expenses for the purchase, receipt, inspection and storage of materials) are allocated directly to products as a percentage premium to direct material costs. In highly automated plants, machine hours (processing time) are also taken into account.

Regardless of whether one or all of these approaches are used, the cost of producing high-volume goods (blue handles) is always significantly higher than the cost of producing the same item in the first plant. Blue pens, representing 10% of production, will require 10% of the cost. Accordingly, purple pens, the output of which will be 1%, will require 1% of the cost. In fact, if the standard costs of labor and machine hours, materials per unit of production are the same for both blue and purple pens (ordered, produced, packaged and shipped in much smaller volumes), then the overhead costs per unit of goods for purple there will be more pens.

Over time, the market price for blue pens (produced in the highest volumes) will be determined by more successful manufacturers specializing in the production of this product (for example, plant No. 1). The managers of Plant #2 will find that the profit margins for blue handles will be lower than those for specialty products. The price of blue pens is lower than purple pens, but the cost estimation system invariably calculates that blue pens are just as expensive to produce as purple pens.

Frustrated by low profits, Plant 2's managers are content to produce a full range of products. Customers are willing to pay more for specialty items such as purple pens, which are obviously not nearly as expensive to produce as regular blue pens. What, logically, should be the strategic step in response to this situation? It is necessary to downplay the role of blue handles and offer an expanded set of differentiated products, with unique features and capabilities.

In fact, such a strategy would be detrimental. Despite the results of the costing system, the production of blue pens at the second plant is cheaper than purple. Reducing the production of blue pens and replacing them with newer models will further increase overhead costs. The managers of the second plant will be deeply disappointed, as total costs will rise and the goal of increasing profitability will not be achieved.

Many managers realize that their accounting systems are misrepresenting the value of an item, so they make informal adjustments to compensate for this. However, the example described above demonstrates well that only a few managers can predict specific adjustments and their subsequent impact on production in advance.

Only a system of functional cost analysis can help them in this, which will not give distorted information and disorienting strategic ideas.

Advantages and disadvantages of functional cost analysis compared to traditional methods

In conclusion, we present the final list of the advantages and disadvantages of the FSA.

Advantages- A more accurate knowledge of the cost of products makes it possible to make the right strategic decisions on:

a) setting prices for products;

b) the right combination of products;

c) the choice between the ability to make one's own or purchase;

d) investing in research and development, process automation, promotion, etc. - Greater clarity about the functions performed, through which companies are able to:

a) pay more attention to managerial functions, such as improving the efficiency of high-value operations;

b) identify and reduce the volume of operations that do not add value to products.

- The feature description process can be overly detailed, and the model is sometimes too complex and difficult to maintain.

- Often the stage of collecting data on data sources by functions (activity drivers) is underestimated

- For high-quality implementation, special software tools are required.

- The model often becomes outdated due to organizational changes.

- Implementation is often seen as an unnecessary "whim" of financial management, not sufficiently supported by operational management.

A cost driver is a process (function) that occurs at the stage of production of a product or service, which requires material costs from the company. A cost source is always assigned a quantity.

For example, with the disclosure of the structure of the activities of divisions, or at the level of the main stages of production

Brief information for heads of manufacturing enterprises

Samara 2004

Sharipov R.Kh.

Samara branch of the International TRIZ Association

OO "TRIZ-Samara"

FSA is work on the mistakes of the enterprise. Technical systems develop according to certain laws. Violation of these laws inevitably leads to material losses for both the manufacturer and the consumer. Functional cost analysis allows you to identify losses and eliminate their causes.

According to American statistics, every dollar invested in the FSA can bring from 7 to 20 dollars in savings by reducing the cost of production.

The main provisions of the FSA

1. The reserve for reducing the cost of production is excessive costs.

2. Excessive costs are associated with the imperfection of the design of products, the technology of their manufacture, the inefficiency of the materials used, erroneous decisions, concepts.

3. FSA assumes consideration not of the object, but of the function that it implements.

4. The task of the FSA is to achieve the functionality of the object with minimal costs in the interests of both the manufacturer and the consumer.

5. The object of the FSA can be products, technologies, production, organizational and information structures, as well as their individual elements or groups of elements.

From the history of the FSA

In the 30s of the last century, the Soviet aircraft designer of Italian origin R.L. Bartini developed a method whose basic concepts were the functional model (ideal end result) and contradiction. The functional approach of Bartini formed the basis of the functional cost analysis. The concept of contradiction formed the basis of the algorithm for solving inventive problems (ARIZ), the main tool of the theory of solving inventive problems (TRIZ), developed by Baku engineer G.S. Altshuller.

At the end of the forties of the 20th century, Yuri Mikhailovich Sobolev, a design engineer at the Perm Telephone Plant, applied system analysis and element-by-element testing of products. He considered each structural element as an independent part of the structure, formulated its functional purpose and included it in the group of main or auxiliary ones.

To constructive elements Yu.M. Sobolev attributed:

Material;

Tolerances;

Thread; -

holes;

surface condition;

This analysis helped to identify excessive costs for the manufacture of auxiliary elements and reduce them without compromising the quality of the product.

At the enterprises of the GDR, on the basis of Sobolev's ideas, element-wise economic analysis (PEA) was created.

During the Second World War, the American company "General Electric" was forced to look for a replacement for scarce materials used in production. After the war, company engineer Lawrence D. Miles, an employee of the supply department who knew about Sobolev's work, analyzed the data on the work of the products and made sure that replacing the material with a cheaper one in some cases led to an improvement in quality.

Based on this analysis, in 1947 a functional-economic approach was developed.

In 1952, L. Miles developed a method called cost analysis. Miles called his method Applied Philosophy.

The practice of applying cost analysis attracted the attention of specialists who worked at enterprises - suppliers, competitors and customers of the General Electric company.

Later, they became interested in the method and state organizations. The first of these was the Navy's Bureau of Ships. Here, the method was first applied at the design stage and became known as value engineering (VE))

In 1958-1960, Japanese consulting engineer Dr. Genichi Taguchi created a series of methods to improve product quality without increasing costs (Taguchi methods). The purpose of the methods is to improve quality by improving accuracy. Any deviation from optimal value is considered as a source of material losses of society (both producer and consumer). Taguchi proved that the loss increases in proportion to the square of the deviation from the optimal value and introduced the concept of "quality loss function" and the signal-to-noise ratio to denote the ratio of the nominal value and deviations.

In 1959, the Society of American Value Engineering (SAVE) was organized. The first president of the society from 1960 to 1962 was L. Miles. The Society had the goal of coordinating the work on the FSA and the exchange of experience between companies. Since 1962, the US military department has demanded from its clients - firms mandatory application FSA when creating ordered military equipment.

In the early 1960s, FSA began to be used in other capitalist countries, primarily in England, Germany, and Japan.

In 1962, a professor at the University of Tokyo, Kaoru Ishikawa, proposed the concept of quality circles, which were based on psychological effects - the effect of social facilitation and the Ringelman effect.

From the mid-1960s, FSA began to be used by enterprises of the socialist countries. In most of these countries, national and international conferences of specialists in the FSA are held, departments and organizations coordinating the application of the FSA on a national scale have been identified. In a number of countries, the introduction of FSA into the practice of economic activity is regulated by legislative documents.

In 1965, the Society of Japanese Value Engineering (SJVE) was founded, which actively promoted this method by holding annual conferences with the participation of representatives of major firms and government organizations.

Systematic and purposeful work on the FSA in the USSR began in 1973-1974. in the electrical industry (VPE Soyuzelektroapparat, PO Electroluch, etc.)

In 1975, the international society SAVE established the L. Miles Prize "For the creation and promotion of FSA methods"

In 1977, the Ministry of Electricity Industry decided to create subdivisions of the FSA in all associations and organizations of the industry, and work on the FSA becomes an obligatory part of the plan for new technology. In 1978-1980. at the enterprises of the electrical industry with the help of the FSA, the following was saved:

14,000 tons of rolled ferrous and non-ferrous metals.

3000 tons of lead

20 tons of silver

1500 people have been released.

The total economic effect amounted to 16,000,000 rubles.

In 1982, Japan established the Miles Award, which is awarded to companies that achieve great success through the use of the FSA.

In Japan, FSA is used in 90% of cases when designing new products and in 50-85% of cases when upgrading products.

At present, the most widely used method is FAST (Function Analysis System Techneque), the foundations of which were developed in 1964 by C. Bythway (Sperry Rand Corporation). Unlike Miles cost analysis, FAST requires finding the relationship between functions.

Since the beginning of the 1990s, in Russia, the number of publications on the FSA has sharply decreased, the training and retraining of specialists has ceased, and the FSA has ceased to be used in production. Specialists were not in demand at home, and some of them work abroad - in Israel, Canada, the USA, Finland, Korea.

FSA organization

Organization of the FSA in Japanese enterprises.

In Japan, the quality improvement movement is nationwide.

1. A national committee for quality circles has been established under the Japan Council of Scientists and Engineers (JASUI), which coordinates the work of regional sections and promotes best practices through the monthly magazine "Quality Circles"

2. The Committee has 9 regional sections, each of which is headed by a representative of one of the leading firms in the region.

3. At each company, the activities of the quality circles are managed by the board of directors, or the headquarters of the circles, which coordinates the work of the workshop quality circles.

4. At some firms there are councils of foremen, which ensure the coordination of the work of shop circles.

5. A course on total quality control is taught in Japanese universities. Company executives are trained in preparation for the Deming Prize competition and at special seminars. Seminars, lectures, courses are constantly held for all categories of workers and employees of firms.

Reasons for the success of the Japanese quality assurance system.

1. Tough competition between enterprises.

2. Rigid subordination in work.

3. Respect for leadership.

4. Democratic nature of the production management system.

5. Equality of rights for all employees of the enterprise (common canteens for managers, employees and workers, collective recreation without distinction of social status).

6. Ability to stop the production process at the initiative of the worker (if problems are detected).

7. Employees of the firm are hired by the firm for life.

8. Technological secrets are known to a wide range of employees of the enterprise.

9. Accurate reflection of the qualities of the product in the title and advertising (truthfulness).

Organization of the FSA at large US enterprises

1. General management and coordination of all work is carried out by the FSA Committee, chaired by the General Director or one of his deputies. The permanent members of the committee are the chief designer, chief technologist, chief economist, heads of supply and sales departments.

2. The implementation of the FSA and the implementation of the proposals are carried out by the permanent groups of the FSA, staffed by specialists who have undergone appropriate training and are exempt from any other work.

3. Temporary groups of the FSA are completed from specialists who own the methodology and represent the main services of the enterprise. Their leaders are appointed released FSA specialists.

4. An engineer with a higher education who has 3 years of experience after 7 - 8 months of training can become a professional specialist in FSA.

1. The decision to conduct the FSA is made by the Ministry. 2

Work on the FSA is included in the plan for the new technology. 3

Allocate the rate of the released head of the FSA.

5. By order of the enterprise, temporary creative teams are formed.