Enterprise management, as well as, for example, government tasks of a socio-economic nature, can be carried out taking into account current uncertainties and risks. What are their specifics? How can they be calculated?

What is the essence of uncertainties and risks?

First of all, let's consider the concept of risk and uncertainty, how these terms can be interpreted in certain contexts.

In some cases, decisions are made under conditions of certainty, which means that the decision maker knows in advance the outcome of his choice. Few decisions are made under conditions of certainty or certainty. On the other hand, in a situation of uncertainty, people only have a very low knowledge base. They do not know whether they are reliable or not and are very unsure about the possible changes that may arise in this situation. Moreover, they cannot evaluate the interactions of different variables; the condition under which decisions are more difficult to make is uncertainty, because in this situation decision makers do not have sufficient information to be clear about alternatives or to assess their risk.

Risk is generally understood as the likelihood of an unfavorable or undesirable event occurring. For example, if we are talking about business, this may be a change in market conditions so that the results of the enterprise’s economic activities will be far from optimal.

Uncertainty is understood as the inability to reliably predict the occurrence of a particular event, regardless of how desirable it can be considered. But, as a rule, uncertainty and risk are considered in the context of the occurrence of unfavorable conditions. The opposite situation, when it is impossible to predict the emergence of positive factors, is quite rarely perceived as uncertain, since in this case there is no need to determine tactics for responding to the relevant factors. While in negative scenarios such tactics are usually needed. This is due to the fact that in conditions of uncertainty and risk, the most important decisions - economic and political in nature - can be made. Let's study how this can be done in more detail.

They are based either on your intuition or your creativity. Political situations are usually so unstable that even experts cannot predict possible changes in them. Of course, a typical situation is risk. A decision maker can evaluate the likelihood of alternatives or outcomes. This ability to assign probabilities may be a result personal experience or secondary information. In a risk situation, factual information may be available but may not be complete.

To improve decision making, one can estimate the objective probabilities of an outcome when using e.g. mathematical models. On the other hand, subjective probability can be used based on judgment and experience. Fortunately, there are several tools that can help administrators take more effective solutions.

How to minimize uncertainty and risks?

Decision-making in an environment characterized by uncertainty and risk is carried out using concepts that minimize the likelihood of errors or various undesirable scenarios. This approach can be effective in a variety of situations.

A rational approach to evaluating alternatives under risk conditions is to use expected value. It is a concept that allows a decision maker to assign a monetary value according to the positive and negative consequences that may arise from choosing a particular alternative. When making decisions, all managers must weigh alternatives, many of which involve future events that are difficult to predict: a competitor's reaction to a new price list, three-year interest rates, the reliability of a new provider.

Uncertainty and risk are thus inherent in many areas of life. modern man. Approaches that are used in cases where it is necessary to minimize errors in certain actions can be based on:

On identifying stable factors that can influence the situation;

Interpretation of certainty, uncertainty and risk. It is also understood as a measure of the likelihood and magnitude of adverse impacts resulting from a hazard and is related to the frequency with which the event occurs. Risk occurs whenever we cannot diagnose with certainty the outcome of some alternative, but we have enough information to predict the probability that should lead us to the desired state of affairs.

Turbulence: In conditions of certainty, uncertainty and risk, the end goal is always clear, but in conditions of turbulence, even the goal may be unclear. Turbulence also occurs when the environment itself is changing at a rate or is actually uncertain. In risk analysis, virtually every decision is based on the interaction of important variables, many of which have an element of uncertainty, but perhaps a fairly high degree of probability. Therefore, the wisdom of launching a new product can be derived from several critical variables: the cost of the product, the investment in capital, the price that can be charged, the size of the potential market and the overall market share.

On the analysis of the resources and tools available to the person who makes the decisions;

On identifying temporary and unstable factors that can also influence the situation, but this is only possible under specific conditions (they also need to be identified).

Among those areas in which the corresponding concepts find the greatest demand is management. There is a point of view that in the context of business management, uncertainty is a management risk, and one of the main ones. Here we find, therefore, another version of the interpretation of the term in question. In the field of management, concepts that explore the essence of various risks are very common. Therefore, it will be useful to first examine how uncertainty and risk are taken into account in the enterprise adoption process.

Example. Managers can understand the true likelihood of a decision leading to desired outcomes. Making decisions under certain conditions. An important class of decision problems includes those in which every action available to the decision maker has consequences that can be known with certainty in advance. Such problems are called decision-making processes under certainty. Making decisions with confidence is not a simple process, and each of the challenges faced in decision making involves the use of theory linear programming.

Business management under uncertainty and risk

In business, the following approach to overcoming possible negative consequences when solving certain problems.

First of all, managers determine a list of objects whose behavior may be characterized by uncertainty and risks. This could be, for example, the market price of a product or service being sold. In conditions of free pricing and high competition, it can be very problematic to clearly predict its course. The risk of uncertainty arises from the point of view of the company's prospects for receiving revenue. Due to falling prices, its value may not be enough to pay off current obligations or, for example, solve problems related to brand promotion.

Certainty or certainty is a condition in which people are fully aware of a problem, alternative solutions are obvious, and possible results every decision is clear. Under conditions of certainty, people can at least foresee facts and their results. This condition means proper knowledge and a clear definition of both the problem and alternative solutions. Once an individual identifies alternative decisions and their expected outcomes, decision making is relatively simple. The decision maker simply chooses the solution with the best potential outcome.

In turn, an unexpectedly sharp rise in prices can lead to the accumulation of excessive amounts of retained earnings by the company. Which, perhaps, in a different situation - with systematic dynamics of revenue receipts - management would have invested in the modernization of fixed assets or the development of new markets.

Once an object characterized by uncertainty and risks from the point of view of business development has been identified, work is carried out to determine the factors influencing the behavior of this object. These may be numbers reflecting market capacity and sales dynamics for enterprises operating in a particular segment. This may be a study of macroeconomic and political factors.

For example, a purchasing agent for a printing company would be expected to order high-quality paper from a supplier offering the best low price And best service. Of course, the decision-making process is usually not that simple. The problem may have many possible solutions, and calculating the expected results of all of them can be extremely time-consuming and expensive.

Making decisions under conditions of uncertainty is an exception for most administrators and other professionals. However, first-line managers make decisions every day with or near certainty. For example, a tight production schedule might force a front-line administrator to ask 10 employees to work four hours of overtime. The administrator can determine the cost overtime with complete confidence. You can also predict with a high degree of confidence the number of additional units that can be calculated with absolute certainty before scheduling overtime.

The concept of risk and uncertainty, as we noted at the beginning of the article, can be associated with processes in the most different areas. Therefore, as a rule, the most wide range factors. For example, those related to financial sector. Let's study how the conditions of uncertainty and risk are explored during decision-making on various monetary transactions.

In many decision problems there are variables that are not under the control of a rational competitor and about which decision makers have little or no information from which to know the state of future things. Decision making under uncertainty occurs when the future cannot be predicted based on past experience. There are often many uncontrollable variables. It is sometimes possible to consolidate the effects of these uncontrolled variables in terms of their probability distributions.

When making decisions under conditions of uncertainty, it is implied that the probability of one or another of the statements about profits and losses is unknown. Risk is the condition under which people can define a problem, determine the likelihood of certain events, identify alternative solutions, and indicate the likelihood that each solution will produce desired results. Risk usually means that the problem and alternative solutions fall somewhere between the extremes presented complete information both definition and unusual and ambiguous character.

Factors of uncertainty and risk in the financial sector

We noted above that enterprise managers, when developing an adoption algorithm management decisions, first they take into consideration an object that may be characterized by uncertainty and risks, then they identify factors that determine the likelihood of the occurrence of conditions under which they can work.

Probability is the percentage of times a particular outcome would occur if a person made the same decision frequently. The quantity and quality of information available to an individual regarding the relevant decision condition can vary significantly, as can assessments of the individual's risk. The type, quantity and reliability of information influence the level of risk and the fact that the decision maker can use objective or subjective probability in assessing the outcome.

Objective probability. The possibility of a particular outcome occurring based on a fait accompli and specific numbers is known as objective probability. Sometimes a person can determine the likely outcome of a decision by examining previous records. For example, although life insurance companies cannot determine the year in which each policyholder will die, they can calculate objective probabilities based on the expectation that past mortality rates will be repeated in the future.

The same can be done when solving problems related to financial management. In the field of monetary transactions, the object that can be influenced by uncertainty (risk is a special case of it) is most often purchasing power capital. Depending on certain conditions, it may increase or decrease. For example, due to inflation in the state’s economy, in the valuation of the national currency. Which, in turn, may depend on macroeconomic and political processes.

Subjective probability. An estimate based on judgment and personal opinions that a particular outcome occurs is known as subjective probability. Such judgments vary from one person to another, depending on their intuition, previous experience in similar situations, knowledge and personal qualities. Often, however, decision makers have information about the probability that each outcome will occur, even if they do not know with certainty the status of the actual outcome.

Making decisions when there are a certain number of possible outcome states for which the probability distribution is known is called a decision at risk. In problems involving uncertainty and risk, the result was a contingency in which the decision maker at worst was completely in the dark and at best had information about the probabilities.

Thus, in the field of decision-making related to capital management, levels of uncertainty (risk - as a particular case, again) can be presented at different levels.

Firstly, at the level of economic macro indicators (for example, GDP dynamics, inflation), and secondly, in the sphere of individual financial indicators (as an option, the national currency exchange rate). Factors at both levels determine what the purchasing power of capital will be.

There are 4 organizational levels. These include three levels of management as well as operational employees. IN general outline, repetitive and routine decisions are best handled with a low level of administration. In contrast, one-time and unique decisions are better handled by senior management.

Likewise, senior management is better qualified to make long-term strategic decisions such as defining the organization's business, direction and strategic global goals for the same and allocation of key capital and personnel resources.

Having identified an object characterized by uncertainty and risks, as well as identifying the factors influencing them, it is necessary to apply the methodology of practical application decision taken. For example, developed by company managers or financial specialists. There are a large number of approaches for this. Among the most common is the use of a decision matrix. Let's study it in more detail.

Middle managers are better equipped to coordinate decisions with medium-term consequences. Frontline managers should focus on more routine departments. Finally, frontline employees are better able to make work-related decisions. The importance of decision making.

This is important because, using common sense, decision making, especially under conditions of certainty, uncertainty and risk, tells us that the problem or situation is assessed and deeply considered in order to choose the best path to follow according to various alternatives and operations. It also has a vital important for management as it helps to maintain the harmony and coherence of the group and hence its effectiveness.

The matrix as a tool for making decisions under conditions of risk and uncertainty

The technique in question is characterized primarily by its universality. It is quite optimal for making decisions on objects that are characterized by economic risks and uncertainty, and therefore is applicable in management.

The decision matrix involves choosing one or more of them based on the highest probability of a chain of factors influencing the object. Thus, the main solution is selected - designed for one set of factors, and if they do not work (or, conversely, turn out to be relevant), then a different approach is chosen. Which involves the influence of other factors on the object.

If the second solution turns out to be not the most optimal, then the next one is applied, and so on, until it comes to choosing the approach that is least desirable, but produces results. Formation of a list of solutions - from the most effective to the least effective, can be carried out using mathematical methods. For example, involving the construction of a graph of the probability distribution of the operation of a particular factor.

The conditions of uncertainty and risk can theoretically be calculated using the methods of probability theory. Especially if the person doing this has sufficiently representative statistical data at his disposal. In the practice of economic and financial analysis, a large number of criteria have been formed in accordance with which the probability of triggering certain factors of uncertainty and risks can be determined. It will be useful to study some of them in more detail.

Criteria for determining probability in the analysis of uncertainty and risks

Probability, as a mathematical category, is usually expressed as a percentage. As a rule, it represents not one value, but a combination of them - based on what conditions for triggering factors are formed. It turns out that several probabilities are taken into account, and their sum is 100%.

The main criterion for assessing the degree of probability of the operation of certain factors is considered to be objectivity. It must be confirmed:

Proven mathematical methods;

The results of statistical analysis of significant amounts of data.

The ideal option is if both tools for identifying objectivity are used. But in practice, such a situation arises quite rarely. Typically, economic risks and uncertainty are calculated with access to a relatively small set of data. This is quite logical: if all enterprises had the same access to relevant information, then there would be no competition between them, and this would also affect the rate of economic development.

Therefore, when analyzing economic risks and uncertainty, enterprises most often have to place emphasis on mathematical aspect probability calculation. The more advanced the company's appropriate methods are, the more competitive the company will become in the market. Let us consider the methods by which the probability of the formation of conditions for the activation of behavioral factors of objects in relation to which a situation of uncertainty can be observed can be determined (risk is a special case of it).

Methods for determining probability

Probability can be calculated:

By analyzing typical situations (for example, when with the greatest probability only 1 of 2 events can occur, as an option: when tossing a coin, heads or tails appear);

Through probability distribution (based on historical data or sample analysis);

Through expert analysis of scenarios - with the involvement of experienced specialists who can examine the factors influencing the behavior of the object.

Having decided on methods for calculating probability within the framework of calculating uncertainty and risks, you can begin to determine it in practice. Let's study how this problem can be solved.

How to determine the probability of an uncertain event in practice?

Practical determination of the probability of operation of a factor affecting an object, which is characterized by uncertainty and risks, begins with the formulation of specific expectations from the corresponding object. If such is capital, then it can be expected to increase, remain at the same level or decrease.

The goals of the financier in this case may be, for example:

Investing capital with declining purchasing power in the modernization of fixed assets;

Formation based Money with stable or growing purchasing power of additional volumes of retained earnings.

Suppose that the financier expects that capital - due to inflationary reasons - will nevertheless reduce its purchasing power, as a result of which it will need to be invested in the modernization of fixed assets. Thus, the risk (degree of uncertainty) in in this case is that a significant amount of capital will be invested in a liquid asset, while its purchasing power may, contrary to expectations, increase. As a result, the company will receive less retained earnings. Its competitors, in turn, can use their capital more efficiently.

![]()

Having determined expectations regarding an object characterized by uncertainty and risks, it is necessary to study the totality of factors influencing the behavior of the corresponding object. These could be:

Economic indicators of the state (including inflation, the exchange rate of the national currency, which we have already mentioned above);

The situation on the market for raw materials, materials and funds in demand by the company (in relation to the value of which the purchasing power of corporate capital is calculated);

Dynamics of capital productivity (determining the prospects for modernization of the company's fixed assets).

Thus, it may turn out that the bulk of the company’s capital is spent on the purchase of raw materials, materials and funds, while they are mainly imported from abroad. Consequently, the growth or decline in the purchasing power of the organization’s funds will depend, first of all, on the dynamics of the national currency exchange rate, and to a lesser extent on official inflation.

The sources of uncertainty (risks) in this case will be of a macroeconomic nature. Thus, the exchange rate of the national currency is influenced, first of all, by the state’s balance of payments, the ratio of assets and liabilities, the level government debt, the total volume of transactions using foreign currency in settlements with foreign suppliers.

So the probability uncertain event- increasing, maintaining a stable value or reducing the purchasing power of capital will be calculated by identifying the main factors affecting the corresponding object, determining the conditions for the operation of these factors, as well as the likelihood of their occurrence (which, in turn, may depend on factors of a different level - in in this case, macroeconomic).

Risk-Based Decision Making

So, we have studied how the probability of the occurrence of conditions for triggering factors that influence the behavior of an object characterized by uncertainty and risks can be calculated. It will also be useful to study in more detail how decisions themselves can be made under conditions of uncertainty and risk.

Modern experts identify the following list of criteria that can be used to guide such tasks:

Probability of observing expected indicators;

Prospects for achieving extremely low and high values for the indicators under consideration;

The degree of dispersion between the expected, minimum and maximum indicators.

The first criterion involves choosing a solution, the implementation of which can lead to achieving an optimal result - for example, in the matter of investing capital in opening a TV factory in China.

The expected indicators in this case can be based on historical statistical data or calculated ones (but based, again, on some practical experience of the specialists who make the decision). For example, managers may have information that the profitability of producing televisions at a factory in China is on average about 20%. Therefore, when opening their own factory, they have the right to expect a similar indicator of the efficiency of capital investment.

In turn, they may know cases in which certain companies did not achieve these figures and, moreover, became unprofitable. In this regard, managers will have to consider such a scenario as zero or negative profitability.

However, financiers may also have information that some firms have managed to achieve an efficiency of investing in Chinese factories of 70%. Achievement of the corresponding indicator is also taken into account when making decisions.

The risk (the result of uncertainty in this case) when considering the possibility of investing in opening a factory in China may lie in the emergence of conditions for the triggering of factors that negatively affect the facility - the level of profitability. Those factors that can lead to the corresponding indicator being negative. At the same time, another result of uncertainty may be the achievement of a profitability of 70%, that is, a figure that has already been achieved by another business.

If negative profitability was shown, relatively speaking, by 10% of factories that opened in China, the figure of 70% reached 5%, and the expected figure of 20% was recorded based on the results of the work of 85% of factories, then managers can quite rightly accept a positive decision regarding investment in opening a television production plant in China.

If, based on the available data, 30% of factories are recorded, managers can:

Give up the idea of investing in factories;

Analyze the factors that may determine such a modest return on investment in the production of televisions.

In the second case, uncertainty and risk in management decisions will be considered based on new sets of criteria in terms of expectations of optimal, maximum and minimum indicators. For example, the dynamics of purchase prices for components can be studied as one of the factors of profitability. Or - indicators of demand in the market to which televisions manufactured at a factory in China are supplied.

Summary

So, we have determined the essence of such phenomena as uncertainty and risk in business. They can characterize a variety of objects. In the business sphere, this is most often the purchasing power of capital, profitability, and the cost of prices for certain assets.

Risk is most often considered by researchers as special case uncertainty. It reflects the likelihood of achieving an undesirable or negative result of any activity.

Risk and uncertainty are concepts that are closely related to the term "probability" related to mathematics. It corresponds to a set of methods that allow one to calculate whether the expectations of a manager, in the case of a business, or another stakeholder, are justified regarding factors that can affect uncertainty and risk in business management.

It is often difficult to reduce the requirements of practical management to one parameter (for example, maximum profit). Problems in which optimization is carried out according to several parameters are called problems multi-parameter or vector optimization. Multi-parameter optimization is an attempt to find some compromise between those parameters for which the solution needs to be optimized.

An important element in such optimization is the assignment of weight coefficients for each optimized parameter. A common method is to determine weight coefficients using the collective opinion of specialist experts using any of the known methods: direct assignment of weights, by assessing the importance of a parameter in points, or by the method of paired comparisons. With any method, as is known, a table of normalized weight coefficients is obtained, and then a generalized weight of each parameter is the result of the examination.

If as a result of detection and processing expert assessments or some weighting coefficients for their target functions are a priori defined - a k, then the generalized target function F about is written as follows:

Where F k –kth objective function,

F k normal– normalizing value k-th objective function,

s– number of components of target functions,

a k is the weight coefficient of the k-th objective function.

The technology for obtaining a solution to a multiparameter problem consists of several steps:

Optimization problems are formulated (for each of the parameters) - and thus F k are determined;

The optimization problem is solved for each of the parameters and thus F k norms are determined;

The degree of relative importance of each parameter within the framework of the task is determined - the weight coefficient of the k-th objective function a k ;

The target function F about is formulated; F k normal in this case, a plus sign is placed in front of the components of the generalized objective function that are maximized, and a minus sign in front of those that are minimized. Values

are taken when maximizing the k-th component F k norms

=F k max ,

are taken when maximizing the k-th component when minimizing it

=F k min .

An optimization problem is solved for a multi-parameter problem.

The following conclusions should be noted:

When solving using a generalized objective function, the values of the required parameters have intermediate values compared to solving using the component objective functions.

This situation does not apply to the values of the variables - their values vary greatly in all options for finding the optimum.

Assigning other values of weighting coefficients can provide solutions that are more acceptable from a management point of view.

Decision making under conditions of uncertainty and riskSubject

Methods for solving multicriteria problems under conditions of lack of information

The concepts of “uncertainty” and “risk”

Often, managers at different levels have to prepare SD in conditions of incomplete or inaccurate information, high staff turnover, dishonesty of suppliers and consumers, frequent changes in legislation, unexpected actions of competitors, etc. As a result, unintentional errors in management decisions are possible.

To find a good solution, you should:

1. Determine the purpose of the decision. 2. Define possible options

solving the problem.

3. Determine the possible outcomes of each decision.

4. Evaluate each outcome.

5. Select the optimal solution based on the goal.

The first stage is defining the goal. The decision maker himself chooses which rule to use, because for each case a specific rule is applicable. They are divided into two groups: Rules for making decisions without using numerical values of probabilities of outcomes ( );

conditions of complete uncertainty Rules for making decisions using numerical values of probabilities of outcomes ( ).

risk conditions

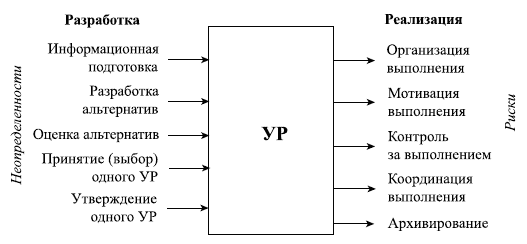

The actual results of decisions do not always coincide with those planned. SD is characterized by both uncertainty and risk. is defined as incomplete, inaccurate, unclear or evasive information about any object or process. Uncertainty is associated with the preparation of SD, and risk is associated with its implementation (Fig. 3). This also includes force majeure events that arise against the will and consciousness of people and change the planned course of implementation of management decisions.

Figure 6 - Uncertainties and risks in the system of procedures for the development and implementation of management decisions 2

Uncertainty as a process - this is the activity of a decision maker who makes insufficiently substantiated decisions either due to incompetence or due to the uncertainty of the external and internal environment, as well as the complexity of the problem situation and limited time.

IN general case uncertainty can be caused either by the opposition of an intelligent adversary, or by insufficient awareness of the conditions under which the decision is made.

Uncertainties can be objective or subjective. Objective ones do not depend on the manager, specialists, experts or, to generalize, on the subjects of development and implementation of management decisions. The source of uncertainty in this case is either in external environment, or outside the influence of subjects developing control decisions.

Let us give the definition of risk. Risk – this is the potentially existing probability of loss of resources (in the form of additional unforeseen expenses) or non-receipt of income associated with the implementation of a specific management decision.

Thus, the risk is characterized probability occurrence and magnitude of losses. To a greater or lesser extent, risk is present in almost all management decisions. It is almost impossible to eliminate it completely. The task of risk management comes down to predicting them, reducing the likelihood of occurrence and reducing adverse consequences.

Risks can be divided into three groups.

1. Risk of achieving the SD (what is the probability of achieving or not fulfilling this SD). For example, the execution risk is estimated at 20%: 80% - this means that in two cases out of ten there is a chance that the decision may not be implemented.

2. The risk of achieving the goal when implementing SD. For example, a risk of 5%: 95% means that in five cases out of a hundred one can expect that the SD goal will not be achieved.

3. General risk (considered as the sum of the risk of achieving SD and the risk of achieving goals when implementing SD). So, if the risk of implementation is equal to 2: 8, and the risk of achieving goals is 3: 7, then the total risk of developing and implementing SD will be equal to 5: 15, or 25%: 75%.

Rules for making decisions without using numerical values of probabilities of outcomes (conditions of complete uncertainty )

1. Maximax solution - maximization of maximum income (Decision based on the criterion of optimism (maximax).

2. Maximin solution - maximizing the minimum income (Decision according to the criterion Walda (maximin )). This criterion is very careful. It is focused on the worst conditions, only among which the best, and now guaranteed, result is found.

3. Minimax solution - minimizing the maximum possible losses (decision on Savage criterion (minimax).

4. The essence of this criterion is to minimize risk. Like the Wald criterion, the Savage criterion is very cautious. They differ in their understanding of the worst situation: in the first case, this is the minimum gain, in the second, the maximum loss of gain compared to what could be achieved under the given conditions. Gurvich criterion

- a compromise method of decision making.

This method of decision making is a compromise between the cautious maximin rule and the optimistic maximax rule. It somehow combines rules that do not consider individual probabilities of individual outcomes and those that do take into account the probabilities of outcomes. When using the Hurwicz criterion, the best and worst results are considered for each solution, i.e. what was previously discussed in the rules of maximin and maximax. The decision maker gives weight

both results, or a coefficient called the optimism coefficient, K o = (0.1). Each row of the payoff matrix contains the largest score and the smallest score. They are multiplied by K o and (1- K o) respectively and then their sum is calculated. The optimal solution will correspond to a solution that corresponds to the maximum of this sum and, by multiplying the results by the corresponding weights and summing, obtains the overall result.

This solution to the problem assumes that there is enough information to determine the weights.

All decision criteria considered lead to different results. Therefore, first, the criterion that the decision maker considers “best” is selected, and then the “best” solution for it is obtained.

As already noted, when making decisions, one should be guided by the relevant rules. The decision maker himself chooses which rule to use, because for each case a specific rule is applicable. So, they are divided into two groups:

Rules for making decisions without using numerical values of probabilities of outcomes;

Rules for making decisions using numerical values of probabilities of outcomes.

Example. 3 Let's say you are the owner of a CakeBox bakery. At the beginning of each day, you need to decide how many cakes you should have in stock to meet demand. Each cake costs you $0.70, and you sell it for $1.30. It is not possible to sell unclaimed cakes the next day, so the remainder is sold at the end of the day for $0.30 each. You need to determine how many cakes should be purchased at the beginning of each day. The table below shows sales data for previous periods.

Table Demand for cakes

Solution.

So, at the beginning of the day you can purchase 1, 2, 3, 4 or 5 cakes per day for subsequent sale. In general, a decision and its outcomes are approximately equal, but while you can make decisions, you cannot control the outcomes. Buyers determine them themselves, so the outcomes also represent an “uncertainty factor.” To determine the probability of each outcome, we make a list of possible solutions and their corresponding outcomes. In table income was calculated, in other words, return in monetary terms for any combination of decisions and outcome:

TableIncome (profit) per day, $

|

Possible outcomes: demand for cakes per day |

|

||||

Using each of the decision rules, you need to answer the question: “How many cakes should CakeBox purchase at the beginning of each day?”

1. Maximax rule- maximizing maximum income. Each possible solution in the bottom row of the table corresponds to maximum income. According to this rule, you will purchase five cakes at the beginning of the day. This is the approach of a card player - ignoring possible losses, counting on the maximum possible income.

Table Maximum Income

2. Maximin rule- maximizing the minimum income. Each possible solution in the top row of the table corresponds to minimum incomes (table). According to this rule, you will purchase one cake at the beginning of the day to maximize the minimum income. This is a very cautious approach to decision making.

Minimum income table

3. Minimax rule- minimizing the maximum possible losses. In this case, more attention is paid to possible losses than to income. The table of possible losses gives an idea of the profits of each outcome that are lost as a result of making a wrong decision. For example, if the demand is two cakes and two were purchased, then the income will be $1.20, but if you purchased three, then the income will be $0.80 and you have lost $0.40. This $0.40 is what it's called possible losses or lost income. The table of possible losses can be obtained from the income table by finding the highest income for each outcome and comparing it with other incomes of the same outcome (see Table 3.7).

As already noted, the rule that is used to work with the table of lost income is the minimax rule. It is also called minimax rule for possible losses. It consists in choosing the maximum possible losses for each decision. Then the solution is selected that leads to the minimum value of the maximum losses (table).

TablePossible losses per day, $

|

Possible outcomes: demand for cakes per day |

Number of cakes purchased for sale (possible solutions) |

||||

Table Maximum possible losses

The minimum amount of maximum loss occurs as a result of purchasing three or four cakes per day. Therefore, according to the minimax rule, you will choose one of these solutions.

All decision criteria considered lead to different results. Therefore, first the criterion that is considered “best” is selected, and then you get the “best” solution for you.

Rules for making decisions using numerical values of probabilities of outcomes

In the previous section we did not use data on the probabilities of outcomes, now let's try to use this data when making decisions.

1. Maximum Likelihood Rule- maximizing the most probable income. Consider the relative frequencies (probabilities) of daily demand for cakes. The table shows sales data in previous periods.

Table Demand for cakes

The highest probability of 0.3 corresponds to a demand of three and four cakes per day. Now consider the income of each outcome and choose the largest.

TableMaximum income For each of the solutions

According to this rule, CakeBox must purchase four cakes per day.

To represent alternatives to a manager's decisions, you can use decision tables or decision trees (goal trees ).

Tabular decision making method

Decision table (or payment table) includes alternatives and their consequences , or exits , which are usually presented in monetary terms (fees).

EXAMPLE. The company is considering the possibility of producing and marketing a new product. Consideration of this project requires the design and construction of a new plant - large or small. The market for this product may be favorable or unfavorable. Of course, there is an alternative to not building or producing anything at all.

Let's create a table for the company based on the following information. Large plant: case of a favorable market - will give a net profit of $ 200,000; unfavorable leads to a net loss of $180,000. Small plant: case of a favorable market - will give a net profit of $100,000; unfavorable results in a net loss of $20,000.

Another example of decision making under conditions of complete uncertainty

If there is complete uncertainty about which state of nature might appear in the table (meaning that we cannot estimate the probability for each possible outcome), then in this case we turn to three criteria for making a decision under uncertainty.

|

Alternatives |

State of nature |

Maximum in a row, $ |

Minimum in a row, $ |

Average in a row, $ |

||||

|

Favorable market, $ |

Unfavorable market, $ |

|||||||

|

Build a big factory | ||||||||

|

Build a small plant | ||||||||

|

Build nothing | ||||||||

|

Equally probable |

||||||||

|

SOLUTION |

Build big |

Build nothing |

Build small |

|||||

Decision making under risk

This is the most common case; it is a probabilistic assessment of the situation and decision. Several possible states of nature can occur and each state has a certain probability.

Considering tabular solutions with conditional states and probabilistic estimates for all states of nature, we can determine expected cash return ( expected monetary value – EMV ) for each option.

This number represents the expected value of the option, or the average payoff for each option, that is, the payoff we would get if we could repeat the decision a large number of times. One of the most popular solutions is to select the option that has the highest EMV value.

EMV i == (Return according to the 1st state of nature) 1 * (Probability of the 1st state of nature) +

(Return according to the 2nd state of nature) 2 * (Probability of the 2nd state of nature) +

(Return on the n-th state of nature) n * (Probability of the n-th state of nature)

CONTINUATION OF THE EXAMPLE

If the manager believes that the probabilities of favorable and unfavorable markets are the same and equal to 0.5, then the EMV for each option can be determined:

EMV 1 = 0.5*200000 + 0.5*(-180000) = $10000

EMV 2 = 0.5*100000 + 0.5*(-20000) = $40,000 (maximum)

The maximum EMV is in option 2, therefore, we will build a small plant.

OTHER EXAMPLE CONDITIONS

Suppose this manager has received an offer from a market research firm to help him make a decision. Market researchers argue that their analysis will tell a company definitively whether the market will be favorable for the proposed product, that is, it will enable it to move from decision-making under risk to decision-making under conditions of certainty and thus protect against a very costly mistake.

Firm marketing research and asks a lot for his service - $65,000.

A lot of questions arise:

Should you hire a firm to obtain the information?

Is this information worth 65,000?

How much could it actually cost?

Determining the value of such perfect information is very useful. This will set an upper limit on the amount that can be spent on the information offered by the marketing consultant.

The value of information can be defined as the difference between the return under conditions of certainty and the return under conditions of risk. They call her expected value of perfect information ( Expected Value of Perfect Information ) – EVPI :

EVPI= (Expected Value Under Certainty) – (maxEMV)

Expected value under certainty is the expected average return if we have reliable information before making a decision. To calculate it, we choose the best alternative for each state of nature and multiply the return it causes by the probability of that state of nature occurring.

CONTINUATION OF THE EXAMPLE

The best outcome for a favorable market is to build a large plant with a payout of $200,000. The best outcome for an unfavorable market is to build nothing with a payout of $0. The expected return under certainty conditions is

($200 000) * 0,5 + ($0) * 0,5 = $ 100 000

Maximum EMV – expected return in monetary terms is $40,000.

Let's define EVPI:

EVPI= ($100,000) – ($40,000) = $60,000.

Thus, the maximum amount a company should pay for perfect information is $60,000. The conclusion is based on the assumption that the probability of each state of nature is 0.5.

Decision making based on a goal tree

The methods we used above included a single solution. In practice, making one decision leads to the need to make the next one, which follows from the previous one. In this case, the tabular method is not suitable, but hierarchical ones are used - decision-making trees, goal or decision trees.

Decision tree – it is a graphical representation of a process that identifies decision alternatives, states of nature, and their corresponding payoff probabilities for each combination of alternatives and states of nature.

The first step is to draw a goal tree and determine the returns of all outcomes for a particular problem.

In this case, it is accepted terms and designations:

Alternative – a direction of action or strategy that can be chosen by the decision maker (DM).

State of nature – a situation that the decision maker cannot influence or has very little influence

Symbols used for decision tree:

alternatives.

CONTINUATION OF THE EXAMPLE

We will proceed from the assumption that we agreed to pay another company only $10,000 for market research. The first decision point is whether or not to conduct market research. If not, then there is a 0.5 probability that the market will be favorable or not.

If a decision is made to conduct research, then nature node number 1 has two branches. We will say that there is a 45 percent chance that the research results will show a favorable market for the product, and a 0.55 chance if the result is negative.

However, there is also a chance that a $10,000 study will not provide accurate or even reliable information. Any market research is subject to error. In this case, there is a 22% chance that the market will be unfavorable, although the research results will be positive.

Finally, when calculating the return, we will take into account our research expenses in the amount of $10,000 in all branches of the top part of the tree.

Having determined all the probabilities and returns, we can begin to calculate the expected returns in monetary terms for each branch. Let's start at the end and (or the right side of the tree) and work backwards. When we're done, we'll know the best solution.

EMV(node 2) = 0.78 * $190,000 + 0.22 * (-$190,000) = $106,400

EMV(node 3) = 0.78 * $90,000 + 0.22 * (-$30,000) = $63,800

EMV(do not build) = -$10,000

If the result of the study is favorable, a large plant should be built

EMV(node 4) = 0.27 * $190,000 + 0.73 * (-#190,000) = – $87,400

EMV(node 5) = 0.27 * $90,000 + 0.73 * (–$30,000) = $2,400

EMV(do not build) = – $10,000

If the study result is unfavorable, the company must build a small plant with an expected return of $2,400.

Continuing to work backwards at the top of the tree, let's calculate the expected value of return from conducting a market study:

EMV(node 1) = 0.45 * $106,400 + 0.55 * $2,400 = $49,200

If market research has not been conducted, then:

EMV(node 6) = 0.50 * $200,000 + 0.50* (-$180,000) = $10,000

EMV(node 7) = 0.50 * $100,000 + 0.50 * (-$20,000) = $40,000

EMV(do not build) = $0

If no research has been carried out, then the best option is to build a small plant.

Thus, we can draw final conclusions : when conducting research, the return is $49,200, without conducting it – $40,000. In the first case, build a large plant, in the second, a small plant.

First Second

Point dot Recoil

Solutions solutions

Favorable market (0.78) $190,000

Big

plant 2 Unfavorable market (0.22) -$190,000

Favorable market (0.78) $90,000

Small Adverse Market (0.22) -$30,000

Study

Results Not – $10,000

acceptable build

Favorable market (0.27) $190,000

1 Large

Plant 4 Unfavorable market (0.73) -$190,000

Conduct Favorable Market (0.27) $90,000

market 5

study Small Adverse Market (0.73) -$30,000

Study Not

build results – $10,000

negative

Favorable Market (0.50) $200,000

Big

plant 6 Unfavorable market (0.50) -$180,000

Favorable Market (0.50) $100,000

Do not carry out 7

research Small Adverse Market (0.50) -$20,000

build

Figure 7 - Tree with payoffs and probabilities for the decision to build a plant

Topic Method of expert assessments. Hierarchy Analysis Method

Expert assessments

For modern market conditions, the old truth “to manage is to foresee” is relevant.

It is possible to systematize the difficulties that arise when developing complex solutions:

initial statistical information Not Always sufficiently reliable; even if it is reliable, it cannot always serve as a reliable basis for making decisions aimed at the future, since operating conditions can change dramatically - sales volumes of a new product, conditions of risk and crisis, etc.;

some information has qualitative character and cannot, in principle, be quantified - the influence of social and political factors, the economic effect of introducing innovations, customer loyalty, etc.;

at the time of decision making no data available , which may affect the implementation of decisions in the future, but they cannot be ignored;

any idea potentially implies the possibility in various ways their implementation, and economic consequences give rise to multiple outcomes that need to be assessed in advance; the assessment is carried out in conditions of limited resources

polysemy, multidimensionality and qualitative difference indicators included in the general criterion for the quality of a solution are an obstacle to assessing the effectiveness, quality, value or usefulness of each of the possible solutions.

Conclusion: When making decisions, the use of calculations must be combined with the use of judgments of managers, scientists, and specialists - experts. This makes it possible to use their individual and collective experience, often “hidden”, expressed simply as common sense. The impossibility of obtaining formalized and absolutely reliable information is mitigated by the use of mathematical and statistical methods of analysis and generalization of expert assessments.

The use of information received from specialists, its collection, synthesis and analysis using special procedures and mathematical methods is called methods of expert assessments.

Basic stages of the peer review process :

Formation of the purpose and objectives of the study, determination of the budget, expected result and its presentation form;

Formation of a group to manage the assessment process;

Choosing a method for obtaining expert information and methods for processing it;

Selection of a group of experts [assessment of expert competence],

Development of a rating system, questionnaires (questionnaires), [pre-processing of ratings]

Survey of experts, assessment of the consistency of expert opinions,

Processing and analysis of survey results,

Interpretation of results and decision making.

The first four stages are carried out by the heads of the organization and the expert research leader appointed by them and are informal in nature.

Presentation and pre-processing of expert assessments